FxWirePro: Delta hedge of NZD/USD as 3 months uptrend now turning adverse and IVs likely to spike

May 20, 2016 13:25 pm UTC| Research & Analysis

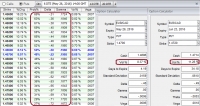

NZDUSD 3 months price bounces have now taken a halt and reversing into bearish sentiments s you can see in the technical charts. The current ATM IV of NZDUSD is at 11.42%, and most likely to jump at 13% ahead of...

FxWirePro: Cross hedging between EUR/GBP/USD as bidding 1m risk reversals

May 20, 2016 12:24 pm UTC| Research & Analysis

Before we begin with hedging framework lets once glance over OTC updates as to why do we prefer cross hedge between these pairs, we are particularly emphasizing on 1m risk reversals. Please be noted that the risk...

FxWirePro: EUR/CAD delta neutrality seems fruitful in hedging strategies when uncertain gamma flux

May 20, 2016 09:58 am UTC| Research & Analysis

With no economic releases today in euro area, market focus may start turning to Greece again. While the Institutions and the Greek government are said to be very close to an agreement on the original and contingency...

May 20, 2016 06:26 am UTC| Research & Analysis

OTC Updates:The current implied volatility of ATM contracts is at 6.19% and little below 9% for 1w expiries but inching higher 12% for 2m tenors which means favourable atmosphere for option holders in OTC markets. But...

Fitch affirms Chile's foreign-currency IDR at 'A+'; outlook stable

May 19, 2016 23:56 pm UTC| Research & Analysis

Fitch Ratings has affirmed Chiles Long-term Foreign- and Local-currency Issuer Default Ratings (IDRs) at A+/AA-. Fitch also affirms Chiles senior unsecured foreign bonds at A+. The Rating Outlook for the Long-term IDRs is...

May 19, 2016 12:17 pm UTC| Research & Analysis

Bounce in realised volatility is most likely upon event risks as stated in our recent write up volatility regimes. Please go through below link for more reading on EURUSD...

FxWirePro: Ideal time to load up weights in EUR/USD vols - 1m-3m IVs encompass event risks

May 19, 2016 11:34 am UTC| Research & Analysis

EUR/USD volatility is trading close to its lowest level since the start of 2015, current ATM IVs are at 9.9%, likely to reduce to 7.38% in 1W expiries. But, implied volatility is probably at the floor of a persistent...

- Market Data