FxWirePro: US Dollar index downside capped by 61.8% retracement, good to buy on dips

Jul 27, 2016 11:29 am UTC| Technicals

Major resistance 97.60 (trend line joining 96.79 and 97.32) Major support - 96.70 The index has recovered after making a low of 96.85. It is currently trading around 97.26. Short term trend is slightly...

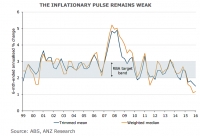

Australia's Q2 CPI data confirm weak inflationary pulse, RBA still in play

Jul 27, 2016 09:54 am UTC| Technicals

Data released earlier today by the Australian Bureau of Statistics showed Australias Q2 CPI data were broadly in line with market expectations. Consumer prices in Australia rose 1.0 percent on year in the second quarter of...

Jul 27, 2016 09:54 am UTC| Technicals

Day highs were not able to sustain at 1.3145 levels and has rejected below 21DMA levels. During the intraday sessions with bearish sentiments mounting as the pair has been attempting to break below supports at 1.3102...

FxWirePro: GBP/JPY faces strong resistance at 140, good to sell on rallies

Jul 27, 2016 09:49 am UTC| Technicals

Major resistance- 140 The pair has recovered sharply after making a low of 135.96. It is currently trading around 138.06. Short term trend is slightly bearish as long as resistance 140 holds. Any indicative...

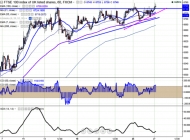

FxWirePro: FTSE100 faces strong resistance at 6760, break above targets 6810/6840

Jul 27, 2016 08:58 am UTC| Technicals

Major resistance- 6760 (Jul 25th high) The index has once again retreated after making a high 6758 and started to decline from that level. It is currently trading around 6738. Short term trend is slightly weak as...

FxWirePro: NZD/USD holds above 0.70 handle, intraday bias lower

Jul 27, 2016 07:43 am UTC| Technicals

Overnight recovery in the pair lost legs just shy of 10-DMA barrier at 0.7082. Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-hovers-around-070-handle-intraday-bias-higher-240368) has achieved all...

FxWirePro: USD/CAD faces strong trend line support at 1.3150, good to buy at dips

Jul 27, 2016 07:20 am UTC| Technicals

Major support 1.3150 (trend line joining 1.29267 and 1.30240) The pair has taken support near 90 H EMA and jumped from that level. It is currently trading around 1.31975. On the lower side support is at 1.3150...

- Market Data