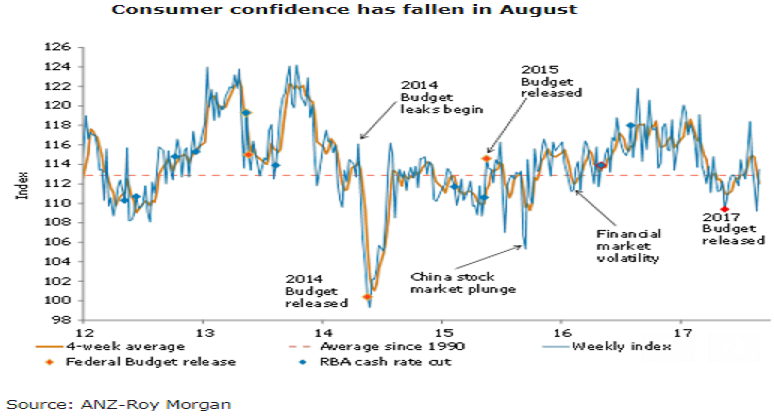

Australia’s ANZ-Roy Morgan consumer confidence rose 3.9 percent last week, after three straight weekly falls. Sentiment rose across the board, with views towards personal finances showing a particularly solid improvement.

Households’ views towards current financial conditions bounced 4.7 percent last week, more than reversing the 4.1 percent fall over the previous two weeks and bringing the index to an 11-week high.

Similarly, sentiment around future financial conditions rose a solid 6.4 percent, following a 5.3 percent decline in the previous week. While sentiment towards current financial conditions remains elevated in level terms, views towards future financial conditions remain below the long term average.

Consumers’ views towards current and future economic conditions rose 5.6 percent and 2.2 percent respectively last week. Despite these gains, views toward both current and future economic conditions are well below long run averages.

Inflation expectations remained at 4.5 percent on a four-week moving average basis. Inflation expectations have increased from their low point in July, perhaps motivated by higher energy costs.

"In our view, despite a strong labor market and moderate economic activity, any improvement in confidence is likely to remain capped until households experience a material acceleration in wage growth, which seems unlikely anytime soon," said David Plank, Head of Australian Economics, ANZ Research.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility