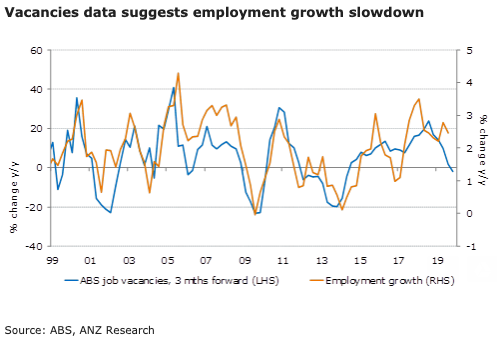

Australian job vacancies fell by 1.9 percent q/q in the August 2019 quarter, bringing annual growth down to -1.9 percent y/y, the first y/y decline since 2014. The decline was concentrated in private sector vacancies, as public sector vacancies continue to grow, ANZ Research reported.

Falling vacancies in the last six months represent a convergence with job ads and other leading indicator data, which have been soft for some time.

Weakness was concentrated in the major knowledge sectors. Professional services fell 12.6 percent q/q and 13.5 percent y/y (the weakest result since 2014) and education fell 7.1 percent q/q and 9.6 percent y/y (the sharpest annual decline in education vacancies in 5 years).

Continuing weakness in construction vacancies (-5.1 percent q/q after -18.7 percent q/q to May) and a sharp decline in health (-8.1 percent q/q) also contributed to the decline.

New South Wales vacancies fell, in annual terms, for the first time in five years (-7.5 percent y/y), while Victoria recorded its second consecutive annual fall (-9.2 percent y/y). All other states/territories experienced vacancy growth, except South Australia.

Meanwhile, falling vacancies in the last six months represents a convergence with job advertisement data, which have been weakening for some time. Weakness in both leading indicators is a strong signal that employment growth could slow in the near term. This is concerning because unemployment has been rising despite strong employment growth in recent months, the report further noted.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX