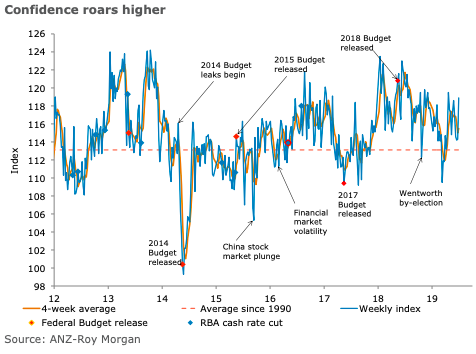

Australia’s ANZ-Roy Morgan consumer confidence jumped by 4 percent, one of the largest increases in a year. On an absolute level, the index is at a two-month high. Financial conditions indices were mixed, with current finances down 2.2 percent, while future financial conditions rose 1.0 percent.

Economic conditions were up by a healthy margin. Current economic conditions gained 13.3 percent after falling for three consecutive weeks. Future economic conditions also showed strength, gaining 7.0 percent, a rise that came after four straight weekly losses.

The ‘Time to buy a major household item’ was up 3.2 percent, taking it close to the levels seen last July. The four-week moving average for inflation expectations was stable at 3.9 percent, although the weekly reading fell to 3.7 percent.

"Confidence was up by a healthy margin on the back of a strong performance by the economic conditions sub-indices. The strength may have reflected better global sentiment arising out of the G20 summit in Osaka and evidence that house prices are stabilising in Sydney and Melbourne. The further gain in the ‘time to buy’ index suggests sentiment toward housing is improving. The RBA decision on the cash rate may impact sentiment this week, though as we saw in June the immediate impact of a rate cut is not always positive," said David Plank, ANZ’s Head of Australian Economics.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed