Australia’s trade surplus in August fell in line with expectations, as export values dipped in the month and imports were broadly steady. The main drag on exports was from non-rural goods, reflecting the drop-off in iron ore prices. Service exports rose during the month and should continue to grow, helped by the weaker AUD, ANZ Research reported.

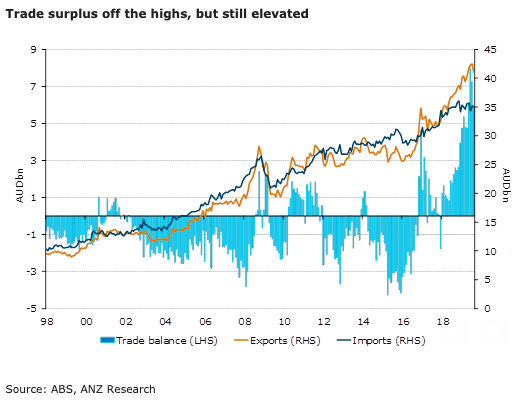

The monthly trade surplus dipped to AUD5.9 billion, still high but down from July’s revised surplus of AUD7.3 billion. Underlying this was a 3.4 percent m/m decline in exports, while imports were down 0.4 percent m/m.

Total resource exports fell 5.5 percent m/m in August, led by a 10 percent decline in metal ores and minerals, while coal fell 4 percent. The volatile non-monetary gold component declined 22 percent (an AUD601 million fall). Manufacturing goods exports were down 2.3 percent but rural goods increased 1.4 percent, helped by 5 percent increases in both cereals and meat. Service exports rose 0.6 percent, as travel increased 0.7 percent.

Capital goods imports dropped 1.9 percent m/m, with a 5.4 percent fall in machinery and equipment more than offsetting 4.2 percent and 26.2 percent rises in transport equipment and civil aircraft, respectively.

Consumption goods imports fell 0.9 percent as household electrical items dropped 3.2 percent. Intermediate goods imports, excluding fuel, fell 3.6 percent as parts for capital goods declined 3 percent. Fuel imports declined 7.2 percent. Service imports rose 1.9 percent as travel rose 0.8 percent.

"Overall, the peak in the trade surplus is in the rear view mirror. However, we expect surpluses to continue, albeit diminishing slowly over time, as the boost from the prior surge in iron ore prices fades," the report further commented.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations