The crypto avenues dragging further to pull back this week, with market benchmark Bitcoin (BTC) now hovering near the US$7000 price level. The price of BTC tumbled 7.65% through this week while the other crypto peers, ETH and XRP, showed slumps about 14.9% and 16.7% respectively (while articulating).

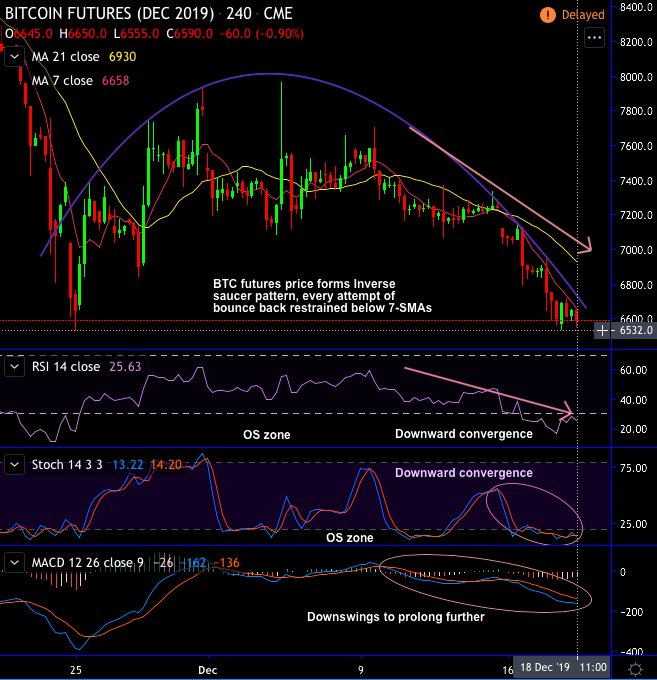

Technically, the price chart of CME BTC futures (of December month deliveries) forms Inverse saucer pattern which is bearish nature, every attempt of bounce back restrained below 7-SMAs (1st chart). So far, it has 9.43% price drops, currently, trading at $6,580 levels.

While the underlying BTCUSD prices (at Coinbase) have slid below psychological 100-EMAs (2nd chart).

The occurrences of shooting star and hanging man patterns plummet prices have bene showing their effects by pulling back prices from the highs of $13,880 to the current $6,588 levels. While both leading oscillators (RSI & Stochastic) and MACD curves are in tandem with the prevailing bearish trend, bearish MACD crossover indicates downtrend to prolong further.

Thereby, the overall crypto market cap slid more than 7%. The market to offer services to institutional crypto traders is increasingly competitive and this week prime brokerage software start-up Tagomi announced plans to cut its fees to less than 0.1% per trade.

In addition, in the current financial conditions across the globe, we are witnessing the lingering concerns over growing debt burden that could potentially lead to another financial crisis. To substantiate this stance, it is quite evident that increasing quantitative easing in the last decade or so, it is most likely to surpass $255 trillion by the end of this year, as per the reports of IIF, IMF and BIS that implies that this mammoth figure projects each person on the planet would carry $32,500 in debt on his shoulder. The increased debt problem is predominantly owing to the excessive quantitative easing mechanism.

Amid such a bizarre scenario, Fed has also made the announcement of repurchase operations (repo), intending to infuse billions of dollars into the markets.

As a result, the potential effect on Bitcoin would be constructive since such a hurried monetary move seems unlikely to affect a decentralized cryptocurrency.

One could observe the growing volumes in CME Bitcoin futures from last two weeks or so (refer 3rd chart). For trading purpose, avoid contracts with lower volumes and lower open interest. Generally, Volume and Open interests would be small at the early stages of futures contract life and it expands as it reaches the maturity period and again drop during close to expiration stage.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data