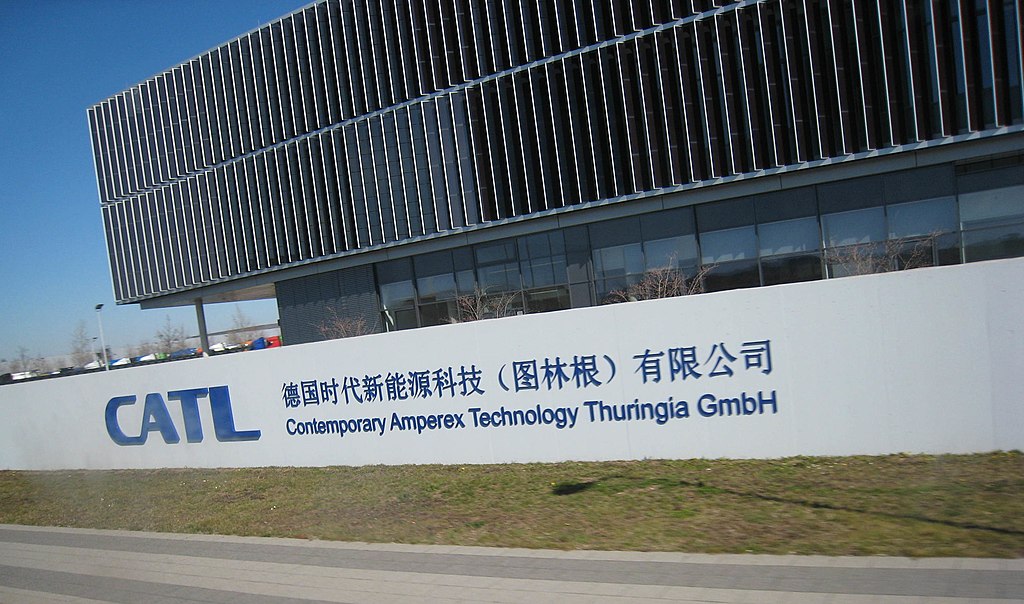

Shares of Chinese battery giant CATL soared 12.5% above their offering price on Tuesday, debuting at HK$296 on the Hong Kong Stock Exchange after raising $4.6 billion. The offering, priced at HK$263 per share, marks the largest Hong Kong listing in 2025 and the biggest globally this year.

Contemporary Amperex Technology Co. Limited (CATL), already listed in Shenzhen, sold 135.6 million shares in its Hong Kong debut. Investor demand was overwhelming, with the institutional tranche oversubscribed by 15.2 times and the retail portion by 151 times. The company also retained a 17.7 million-share greenshoe option, which could raise the total to $5.3 billion, rivaling Kuaishou’s $6.2 billion listing in 2021.

Founder and Chairman Robin Zeng described the listing as a key step toward deeper global capital market integration and a move to advance the zero-carbon economy. The IPO comes amid a temporary trade truce between the U.S. and China, with tariffs on both sides significantly reduced. This geopolitical shift helped attract long-only global investors who previously held back, according to insiders.

CATL's strong debut reflects growing investor confidence, driven by robust earnings and global market leadership. In Q1 2025, CATL reported a 32.9% year-on-year net profit increase, reaching 14 billion yuan ($1.91 billion)—its fastest growth in two years. The company continues to dominate the EV battery sector with a 38% global market share in 2024, up from 36% the previous year, according to SNE Research.

Despite a slight dip of 0.5% in its Shenzhen shares, CATL’s Hong Kong debut underscores its rising international appeal and the strong momentum behind clean energy investments.

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering