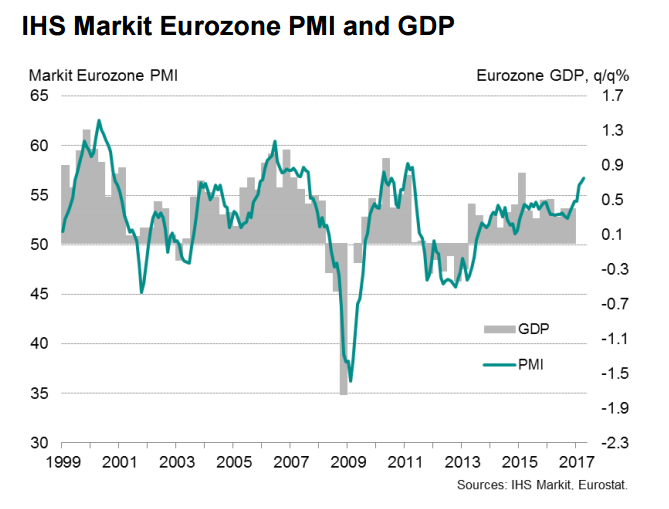

Eurozone PMI preliminary ‘flash’ estimate data released earlier on Tuesday showed that Eurozone economy has maintained its excellent momentum in May. IHS Markit's Flash Composite Purchasing Managers' Index for May, seen as a good guide to growth held out at 56.8, the same reading as in April. Job creation surged to one of the strongest recorded over the past decade amid improved optimism about future prospects.

Manufacturing led the upturn, with output growth accelerating to the fastest in over six years. Flash Eurozone manufacturing PMI came in at 57.0, a 73-month high, compare to a reading of 56.7 in April. Service sector business activity growth also remained strong, easing only marginally to 56.2 from April’s six-year peak of 56.4 to underscore the broad-based nature of the upturn.

"The consensus forecast of 0.4 percent second quarter growth could well prove overly pessimistic if the PMI holds its elevated level in June," said Chris Williamson, Chief Business Economist at IHS Markit.

Average selling prices for goods and services rose at the second-fastest rate since July 2011. However, input cost inflation eased slightly to a five-month low suggesting that price pressures could be easing a little in the months ahead. Declining price growth will suggest ECB could stay on course with its expansionary policy stance.

“Although the pace of economic growth signalled by the PMI is historically consistent with the ECB taking a hawkish stance, the dip in cost pressures will add weight to arguments that there’s no rush to taper policy,” adds Chris Williamson.

EUR/USD is continuing its winning streak from the past two weeks and hit fresh six months high at 1.12678. We have seen a "Bearish Bat Pattern" formed on the daily charts with Potential reversal zone at 1.13660. Short term bullishness can be seen only above that level. On the lower side, minor support is around 1.116 (23.6% retracement of 1.08290 and 1.12635) and break below will drag the pair till 1.10985 (23.6% retracement of 1.05674 and 1.12635)/1.1050. Immediate resistance is around 1.1299 and any break above will take the pair till 1.13660/1.150 level.

FxWirePro's Hourly EUR Spot Index was at 101.635 (Bullish), while Hourly USD Spot Index was at -150.947 (Bearish) at 1000 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns