After exiting a $19.5 billion joint venture with Vedanta, Foxconn revealed intentions to utilize India's $10 billion Modified Programme for Semiconductors and Display Fab Ecosystem, aiming to establish a thriving semiconductor manufacturing scene, a major blow to Prime Minister Narendra Modi's ambitions.

The multinational electronics manufacturer, acknowledged as the world's largest in its field, disclosed on Tuesday its efforts to apply for benefits under India's Modified Programme for Semiconductors and Display Fab Ecosystem. This $10 billion initiative offers incentives of up to 50% of capital costs for semiconductor and display manufacturing projects.

Foxconn has been actively assessing potential partners and remains committed to India's vision of establishing a thriving semiconductor manufacturing ecosystem. Despite the setback caused by the Vedanta breakup, the company plans to forge new alliances on its journey forward. Prime Minister Modi, who has placed great importance on chipmaking as a catalyst for a "new era" in electronic manufacturing, previously applauded the joint venture as a significant development.

Confidential sources reveal that Foxconn is currently discussing with various local and international entities, exploring the possibility of manufacturing semiconductors in India. These discussions focus on mature chip manufacturing technology and encompass a range of products, including electric vehicles (EVs). It is worth noting that the identity of these partners remains undisclosed.

Despite the dissolution of the partnership, Vedanta remains fully committed to its semiconductor project and has secured alternative partners to develop India's first foundry. The company has expressed unwavering determination to realize Modi's vision.

Sources familiar with the matter cited concerns about the delay in the approval of incentives by the Indian government as one of the contributing factors behind Foxconn's withdrawal. The government in New Delhi raised questions regarding the cost estimates submitted to seek incentives. These factors collectively led to Foxconn's exit from the venture.

Chipmaking is paramount to India's economic strategy, and Modi has endeavored to attract foreign investors to establish local chip production facilities for the first time. While India is a late entrant to the global chip manufacturing landscape, this ambitious project aimed to transform the country's electronics manufacturing industry. According to industry projections, India's semiconductor market is expected to reach $63 billion by 2026.

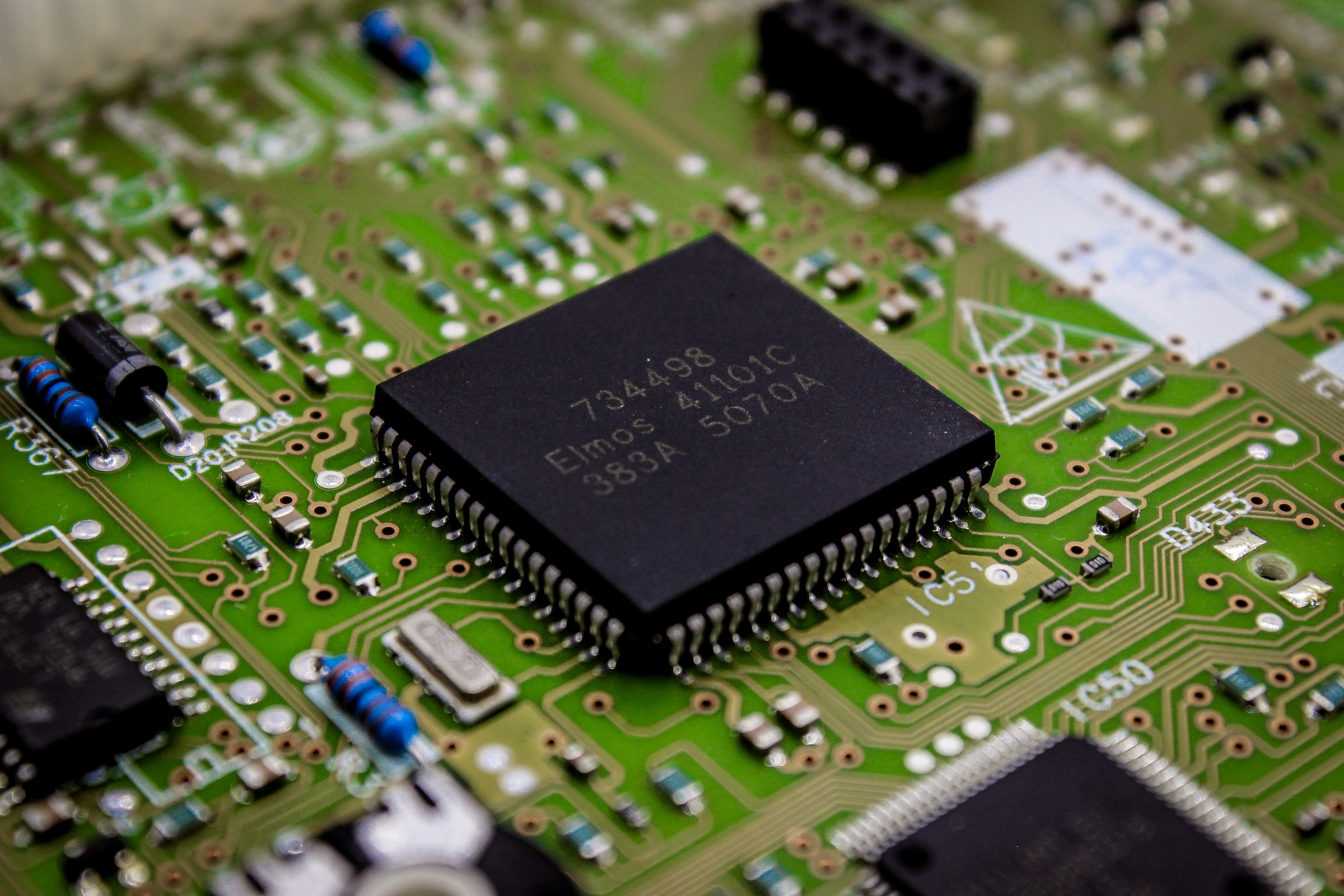

Photo: Bermix Studio/Unsplash

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race