The Mexican central bank’s (Banxico) meeting minutes give the impression that massive rate cuts in support of the economy are rather unlikely. Even though the central bank cut its key rate by 50bp to 6.5% on 20th March, one week ahead of the regular meeting, one of the five members voted in favour of a smaller 25bp cut. And the minutes sound clearly cautious. On the one hand the central bank sees a high upside and also downside risk for inflation. After all what is going to be more pronounced? The supply side or the demand shock? And to what extent will the weak peso push inflation upwards? Can the significant fall of the oil price and other commodity prices (over) compensate for this development? And in the end of course the realisation that it is really up to the Ministry of Health and that of Finance to control the pandemic and cushion economic effects. The high Mexican key rate was so far unable to prevent the peso from depreciating significantly. Uncertainty is too high for that. From a longer term perspective, once the situation has calmed down again and investors begin investing in EM asset once again, it might help the peso that interest rates in Mexico are comparatively high (we only expect moderate rate cuts this year to 5.75%). Until then investors are more likely to be driven by concerns that both monetary and fiscal policy have reacted only moderately to the deterioration of the economic situation. The peso should therefore continue to struggle.

OTC Updates and Options Strategies:

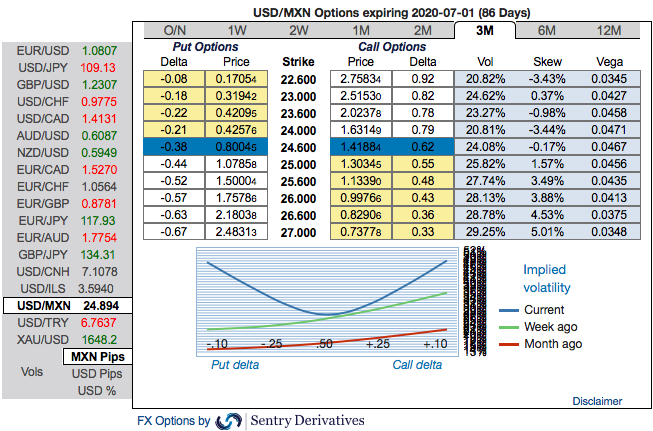

As stated in our previous posts, the positively skewed IVs of USDMXN of 3m tenors have delivered as expected and have still been indicating upside risks, while IV remains on lower side and it is perceived to be conducive for options writers.

It is analysed that earning theta without taking left tail risk via high beta ratio call spreads. Such structures are covered to a fair extent against spikes of high beta volatility given the long risk-reversal sensitivity embedded in the structure.

Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years.

3M USDMXN ATM/25D 1*1.5 vol ratio call spread vs 22.80/25.77 indicative. Courtesy: Sentry & Commerzbank

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures