Bank of England left its monetary policy unchanged but the dissenting votes for an immediate 25bps hike, from the current Bank Rate of 0.50%, rose from two to three (Chief Economist Haldane, who has broken ranks verbally before, joined known hawks McCafferty and Saunders). In addition, due to the generally lower levels of rates, the Bank lowered the rate at which they would consider altering their asset holdings to 1.5% (from 2.0%). That remains a distant prospect given that their outlined path of three 25bps rises is over the next three years. The statement and minutes confirmed their prior view that the economy was recovering as projected and that 1Q weakness was temporary.

Over 2018, we see scope for some further underperformance from NZD, as we expect ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3. Evidence that real assets (equities, housing) are threatened by late cycle growth dynamics and government intervention would add further weight to this story. NZDUSD is expected to depreciate to 0.66 by 2Q’19.

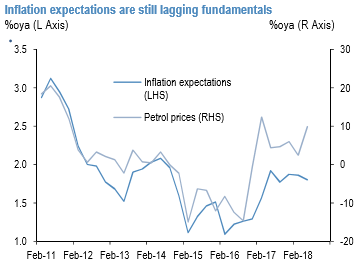

RBNZ Governor Orr’s first MPS maintained the low for long policy guidance, with an evenly balanced outlook for the near-term. The Governor stated the next move is equally likely to be up or down and has placed significant weight on the fact that inflation expectations have become more backward-looking, which slows the recovery from several years of below-target outcomes. Such headwinds were highlighted in the most recent RBNZ expectations survey, where 1Y forward expectations remain lower than would be expected, in the context of rising oil prices (refer 1st chart).

NZD faces domestic headwinds to local rates that are only now being fully appreciated. Growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government.

While the Aussie has been one of the worst performers in the broad-based US dollar rally since the June FOMC and ECB meetings. But the RBA should also be optimistic on Australia’s growth outlook in its Aug statement. Courtesy: JPM & Westpac

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -26 levels (bearish), while hourly USD spot index was at -110 (bearish), GBP flashes at 139 (bullish) and AUD at 35 (bullish) while articulating at 07:32 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed