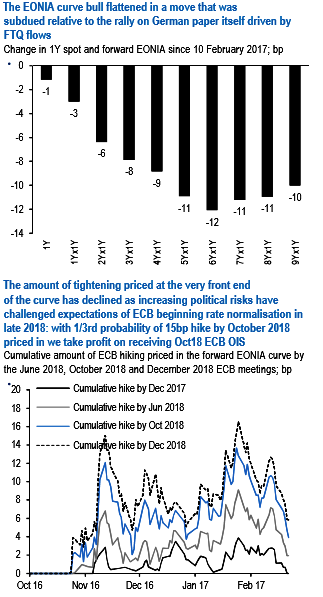

The EONIA curve bull flattened with a notable outperformance of post 5Y forwards (refer above diagram). The dynamic was different relative to the German curve, where the large outperformance of Schatz led to bull steepening of the German curve. Flight-to-quality flows on increasing concerns on French political risks were the main drivers.

The amount of tightening priced at the very front end of the curve has declined as increasing political risks have challenged expectations of ECB rate normalization in late 2018. We still believe that the ECB will increase policy rates 6M after the end of QE purchases which we expect at June 2018. With the market now pricing about 1/3rd probability of a 15 bp hike in the deposit rate by October 2018 (refer above diagram), we take profit on receiving Oct18 ECB OIS.

After the recent rally greens EONIA are now priced fully in line with our risk scenario of ECB starting to hike rates in late 2019 limiting the attractiveness of long positions in the sub 3Y sector (refer above diagram). Further out we are still biased for a steeper money market curve but we acknowledge that the political risks are going to limit the rate normalization priced in by the ECB, given the risk scenario of a Le Pen Presidency and potential EMU/EU referendum.

We prefer to hold steepening exposure in the money market curve via conditional structures. Specifically, we hold reds/blues weighted swap curve conditional steepener via 3M midcurve payers. The weighted curve continues to remain strongly directional and is currently trading too flat vs. yield levels (refer above diagram).

Two weeks ago we recommended conditional bull flattener to hedge against the risk of further FTQ driven rally combining the bull flattening view of the swap curve (1s/5s) with the bull widening view in Bobl swap spreads. Over the period the swap curve the bull flattened and Bobl swap spreads widened 8bp (refer above diagram). Thus we tactically take profit on 1Y swap/Jun17 Bobl conditional bull flattener. The richening of Bobl implied volatility has reduced the attractiveness of this conditional structure, with 3Mx1Y implied now priced at about 20-25% of Bobl implied volatility.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons