Bearish EURNZD Scenarios:

1) ECB goes all-in with rates cuts, tiering and QE.

2) Trump proceeds with tariffs on Euro car imports.

3) A no-deal Brexit.

4) Kiwis fiscal easing is accelerated;

5) Housing begins to lift thanks to lower mortgage rates and a winding back of LVR restrictions.

Bullish EURNZD Scenarios:

1) Trump sanctions unilateral FX intervention to weaken USD.

2) A US-China peace treaty on trade.

3) Euro area economy rebounds to a sustained 1.5%+ growth rate and re- acceleration of CB demand for EUR.

4) The housing market slowdown becomes deeper due to credit tightening by banks;

5) The immigration rolls over more quickly;

6) The global risk assets start to respond more sharply to global trade and growth concerns.

OTC outlook and Hedging Strategy:

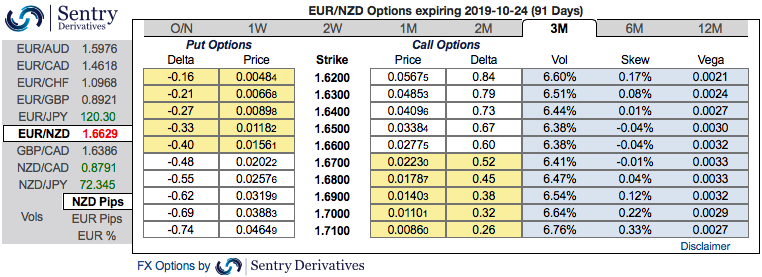

Please be noted that the positively skewed IVs (implied volatilities) of 3m tenors signify the hedgers’ interests on both upside and downside risks (refer above nutshell). Bids for OTM calls and OTM put strikes up to 1.71 and 1.62 levels are observed ahead of ECB monetary policy that is scheduled for tomorrow.

Contemplating all the above factors, we could foresee upside risks of this pair. Hence, we advocate 3m (1%) in the money delta call options.

Thereby, in the money call option with a very strong delta will move in tandem with the underlying spot fx.

Alternatively, we also advocate directional hedges as downside risks in the near terms are foreseen ahead of ECB’s monetary policy, initiate shorts in EURNZD futures contracts of near month expiries and simultaneously, longs in mid-month tenors with a view to arresting major uptrend. Courtesy: Sentrix & JPM

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close