This write-up emphasizes on the execution and functioning of the two advocated Scandi trades — long EURSEK establishing a bearish seagull options strategy and long NOKSEK outright has been weak in the last week.

Recollect that these were initiated as tactical shorts and redirected in:

- A robust conviction on bullish NOK scenario with the Riksbank still looking vulnerable to deferrals, and;

- In a defensive scenario given poor growth momentum in the region which was expected to additionally weigh on a high beta currency like SEK. However, several unexpected developments have unfolded.

On a more distinctive level, a more resolute communication from the Riksbank on a rate hike in either December or February following its September meeting communicated via minutes and speeches and at the same time, a slightly more dovish message from the Norges Bank eroded performance. Even though the NB ended up delivering the 25bp rate hike that was widely expected, it modestly flattened the rate path (by 4bp for 2019 and 2020). This was only a modest change by the Norges Bank’s own admission as well, but nonetheless in a dovish direction and also in contrast with Riksbank’s stance. In addition, a more positive tone in high beta currencies (despite an escalation of trade risks and a softer Euro area PMI) also contributed to SEK’s outperformance.

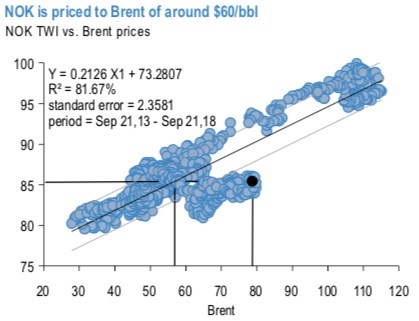

The Norges Bank outcome doesn’t warrant a re-think of our (structurally and tactically) bullish NOK view. Conditions remain favorable of NOK outperformance given that NOK continues to remain weak to oil (refer 1stchart) and also since our commodity strategists have recently upgraded their outlook on oil prices (Brent is expected to approach $85/bbl in 4Q’18).

However, the Riksbank’s resolve on hiking rates in December/ February, in conjunction with commentary indicating less dependence of policy action on the interim inflation reports is greater cause of concern for our tactical SEK shorts (recall that longer-term, lower conviction view is still SEK bullish). This is especially the case since SEK continues to screen cheap vs. EUR despite its recent outperformance (refer 2ndchart).

Contemplating these risks, SEK short exposure is underweighted by incurring losses on the EURSEK bullish seagull. While long NOKSEK recommendation is retained as the cross is at the lower end of its recent range and the performance of NOK and SEK will likely not decouple as meaningfully.

Bought NOKSEK in spot at 1.0830. Stop at 1.06.

Bought 2m EURSEK 10.60-10.75 call spread vs. sell 10.3050 put for 18.6bp. Spot ref 10.5720. Squared-off at -0.91%. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -2 levels (which is neutral), while hourly USD spot index was at 61 (bullish) while articulating (at 10:19 GMT). For more details on the index, please refer below weblink:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?