Ahead of BoC’s monetary policy on 9thJanuary, loonie still appears to be weaker, testing fresh lows into Christmas and New Year holidays. CAD is fundamentally vulnerable as crude oil prices hit fresh lows; liquidity deteriorating.

The outlook for relative central bank policy (BoC) is deteriorating as Fed tightening expectations recover while those for the Bank of Canada hold steady, with OIS only pricing about 20bpts of BoC tightening by May. CAD seasonals remain bearish, given the currency’s tendency to weaken into year end and base around the end of January.

As the BoC’s probability of its hiking cycle over the next two years, whereas the Fed’s end of its own cycle next year, one can expect the CAD to appreciate.

The CAD is soft, down 0.2% vs. the USD and drifting to fresh 18 month lows in response to the continued decline in oil. WTI is threatening $45/bbl and domestic rate expectations have softened considerably. The outlook for relative central bank policy has deteriorated and yield spreads are extended. Our FV estimate for USDCAD using 2Y, 5Y spreads and WTI is in the lower 1.36s.

While the FX options market remains remarkably optimistic and risk reversals are consolidating. Fundamentals remain weak and liquidity conditions are deteriorating into the holidays.

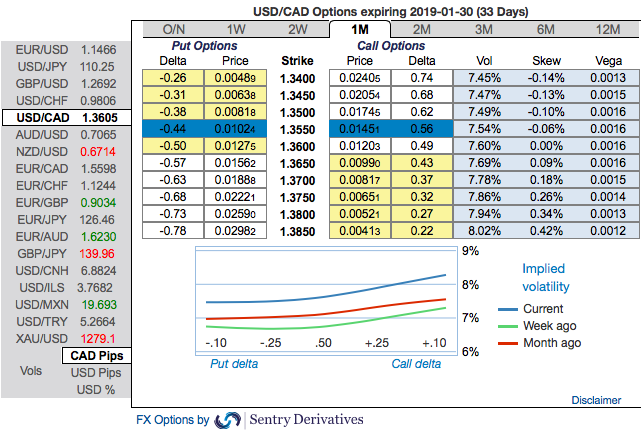

USDCAD OTC indications and options strategies:

At spot reference: 1.3606 level, 1M ATM IVs are trading a shy above 7.45% - 8.02%, skews are also suggesting the odds on OTM call strikes upto 1.3850 levels at this juncture. We could also notice bullish risk reversals additions of this tenor that signals further upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favour optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Thus, call spreads are preferred option structures given elevated skew and favourable cost reduction.

At spot reference: 1.3606 levels, we execute USDCAD 1m/1w call spread with strikes of 1.3450/1.38 for a net debit.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader finances the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Source: Sentrix, saxo and scotiabank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -30 levels (which is mildly bearish), hourly USD spot index was at 37 (mildly bullish) while articulating at (13:08 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays