Tonight the Mexican central bank (Banxico) is likely to cut its key interest rate by another 50 bps. Inflation fell to 2.2% in April, below the central bank's inflation target. With regard to the economy, which has slid into an even deeper recession due to the coronavirus pandemic, the current 6% key rate appears too high.

In fact, even a more substantial cut would be justified. However, core inflation, which stood at 3.5% in April and has hardly fallen at all in recent months, is a cause of concern for the central bank and is likely to prevent it from taking a bigger interest rate cut. As this should be priced in, the interest rate decision should have no effect on the peso today. Instead, the financial markets are likely to continue to look at developments in the corona pandemic. Mexico has announced that it will be easing restrictions next week.

On the one hand, this is good for the economy, but on the other hand there is concern that this is premature. If the pandemic in Mexico cannot be brought under control, there is a threat of renewed restrictions. With this in mind, financial markets are likely to remain nervous, and the peso will continue to trade weak against the USD.

OTC Updates and Options Strategies:

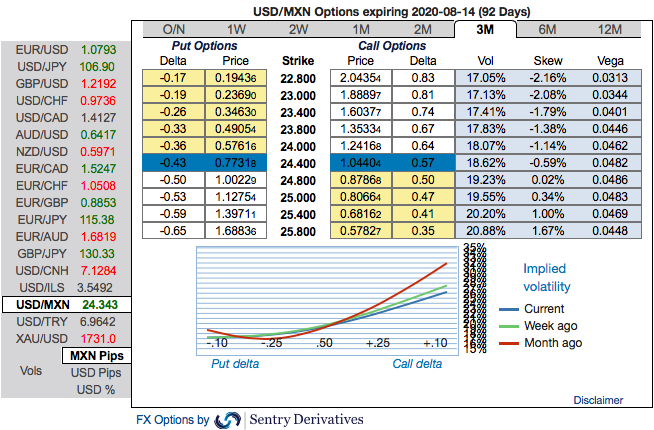

As stated in our previous posts, the positively skewed IVs of USDMXN of 3m tenors have delivered as expected and have still been indicating upside risks, while IV remains on lower side and it is perceived to be conducive for options writers.

It is analysed that earning theta without taking left tail risk via high beta ratio call spreads. Such structures are covered to a fair extent against spikes of high beta volatility given the long risk-reversal sensitivity embedded in the structure.

Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years.

Buy 3M USDMXN ATM/25D 1*1.5 vol ratio call spread vs 22.80/25.77 indicative, (spot reference: 24.3020 levels). Courtesy: Sentry & Commerzbank

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal