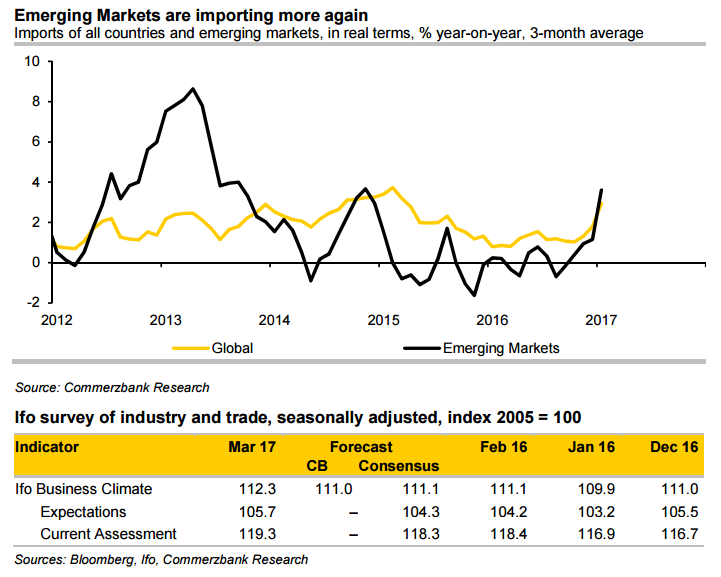

The German Ifo business climate index surprised markets to the upside, suggesting that German businesses are brushing aside potential risks like Brexit, Trump or Le Pen. German Ifo business climate index for March came in at 112.3 points, its highest level since July 2011. Data beat analysts’ expectations for a slight rise to 111.1 for the month.

The boost to the headline index came from both components of the business climate index. Improvements were seen in the sub-indices for both current trading assessments and future expectations, which rose to 119.3 and 105.7 respectively. The trade and industry component rose to 17.4 from 15.0 with a strong gain in the manufacturing sector. Construction edged higher on the month with the current situation at the strongest level since 1991. Retail confidence was also higher, although there was a retreat in wholesaling after a surge seen last month.

Data follows last week’s PMI surveys, which suggested the German economy was in its best health for six years. Moreover, demand from the emerging markets has leapt in past months, after a general stagnation in the two years before. German businesses largely muted to risks from Brexit, Trump’s protectionism and the advance of anti-establishment forces in the eurozone. Upbeat Ifo business climate data adds to the evidence that euro zone's biggest economy is gaining momentum.

"German GDP should rise significantly in the first quarter; we anticipate a plus of 0.7% on the fourth quarter. For the full year in 2017, we expect a growth rate of 1.6%. Chancellor Merkel is gaining tailwind from this economic growth," said Commerzbank in a report.

EUR/USD was trading at 1.0876, up 0.74 percent at around 1200 GMT. Markets now await data from the European Commission which will publish a gauge for economic confidence in the 19-nation currency bloc on Thursday, and the European Union’s statistics agency will release March inflation data on Friday.

Technical studies are bullish and support further upside in the pair. The major finds stiff resistance at 1.0884 (200-DMA). Break above 200-DMA is likely to take the pair higher. We see next major resistance at 1.0950 levels (weekly 50-SMA). FxWirePro's Hourly EUR Spot Index was neutral at 18.1931. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions