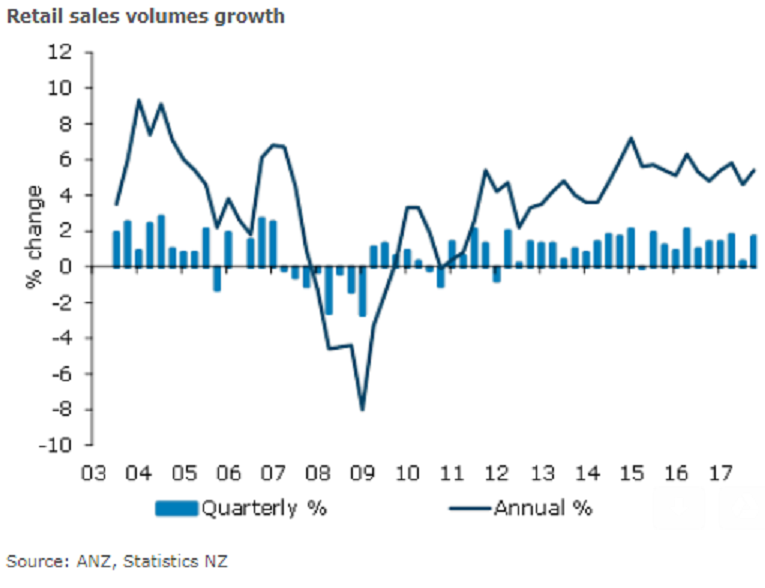

New Zealand’s retail sales volumes were stronger than expected in Q4, with retail discounting, especially across big-ticket items – continuing to have a key influence. Retail sales volumes rose solidly (beating market expectations) in Q4, lifting 1.7 percent q/q. This follows modest (but upwardly revised) growth of 0.3 percent q/q in Q3. In per capita terms, real spending rose 1.1 percent q/q, which easily reverses the small dip experienced in Q3 (which was only the second fall in the past five years).

Eleven of the 15 retail industries saw higher sales volumes in the quarter. There was especially strong growth in food and beverage services (+3.7 percent q/q), which could be a reflection of the unseasonably warm weather over the latter part of the quarter. Apparel spending also rose strongly for the second consecutive quarter (+4.0 percent q/q). But it doesn’t appear to have been a tourism-related story, with accommodation spending down 2.3 percent q/q.

After a mixed Q3, motor vehicle sales rose 2.1 percent q/q and furniture and floor coverings lifted 3.6 percent q/q. There were also solid gains in electrical and electronic goods (2.6 percent q/q). Interestingly, the implied prices for all of these components fell in the quarter, highlighting the ongoing theme of price competition.

Further, nominal spending rose only 0.5 percent q/q in both Auckland and Wellington, but it was strong in the likes of the Waikato, Bay of Plenty and Gisborne. The labour market is strong, and wage growth is expected to tick higher. Interest rates remain low and competitive price pressures should persist.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out