Data released by Norway's real estate industry association last week showed that Norwegian seasonally adjusted housing prices fell by 0.7 percent in May from April in a further sign the market was cooling off from a rapid rise in recent years. Data showed that house prices rose by 8.3 percent y/y in May, down from 10.7 percent in April and from a decade-high 13 percent in February. Unadjusted prices fell by 1.1 percent in May from April, the weakest nominal outcome for a single month since October of 2015.

The Norwegian government at the start of the year imposed tougher banking regulations to curb mortgage lending an help limit the growth in property prices. In addition, housing starts have risen significantly aiding cool the property market. Norges Bank probably still see the housing market as an argument against cutting rates, as household credit growth is still very high. Household credit growth was 6.5 percent y/y in April, just 0.2pp slower than in March.

"We stick to our view of unchanged policy rates in June and going forward and believe inflation has to come further down before rates are cut. A few months of falling house prices will not be enough to trigger a rate cut either, but a large fall and indications it will hit the real economy through lower housing investment and private consumption may. But we are far from that scenario at the moment," said DNB Bank in a report to clients.

Economic data out of Norway has been mixed during the last weeks. Improvement was seen in capacity utilization and unemployment fell, while inflation remained below Norges Bank’s projection from March. Registered unemployment (unadjusted) fell 0.2 percentage points to 2.6 percent in May.

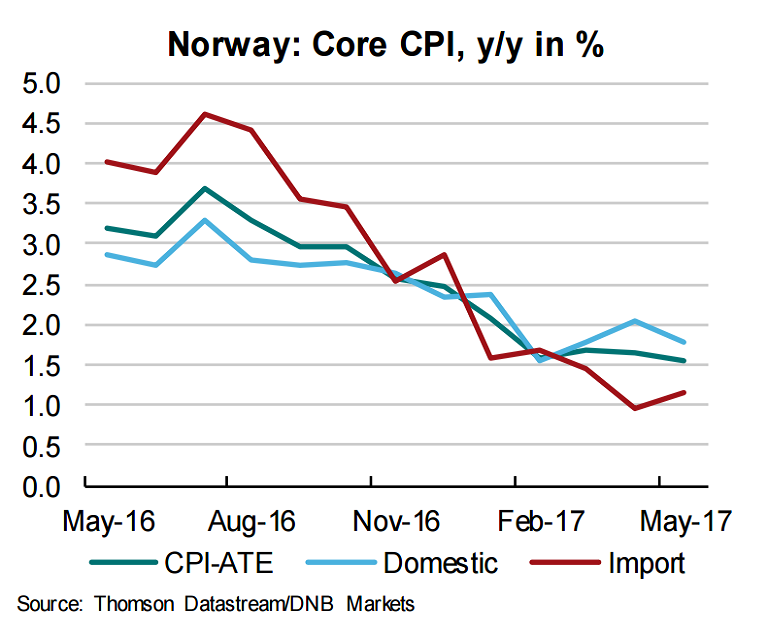

Norway's inflation rate fell further below its target level in May, despite the end of Easter sales and the first monthly increase in fuel prices for four months. Consumer prices were 2.1 percent higher than the same time last year, compared to the previous month’s 2.2 percent rise. Core inflation (CPI-ATE) which strips out more volatile factors such as energy prices, was only 1.6 percent. The Norges Bank currently targets a rate of 2.5 percent and has indicated it is unlikely to cut rates to try to stimulate inflation back toward the target.

EUR/NOK was trading at 9.5052 at the time of writing, largely unchanged on the day. The pair remains capped below 5-day MA at 9.5220 and momentum indicators suggest further declines. We see scope for test of 20-DMA at 9.4392. Violation there could see test of trendline at 9.4090.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns