Riksbank's executive board on January 4th came up with the extraordinary move to allow its governor Mr Ingves and his first deputy governor, Kerstin af Jochnick to intervene in foreign exchange markets at any time. This is the latest attempt by the central bank in its determined campaign to try to rein in a soaring Swedish krona and boost inflation. Sweden's price growth has not exceeded the bank's 2 per cent target since 2011 raising concerns that the country could slip into deflation, threatening wages and dragging down the broader economy.

The Riksbank also said that "appreciations as a result of slowdowns in economies abroad (...) may need to be addressed using interventions". Taken at face value the Riksbank's announcement suggests it could sell the SEK even if EUR/SEK stays range-bound. Furthermore, should the Riksbank opt to intervene, market participants could speculate about the second-round effects on other currencies from potential diversification flows.

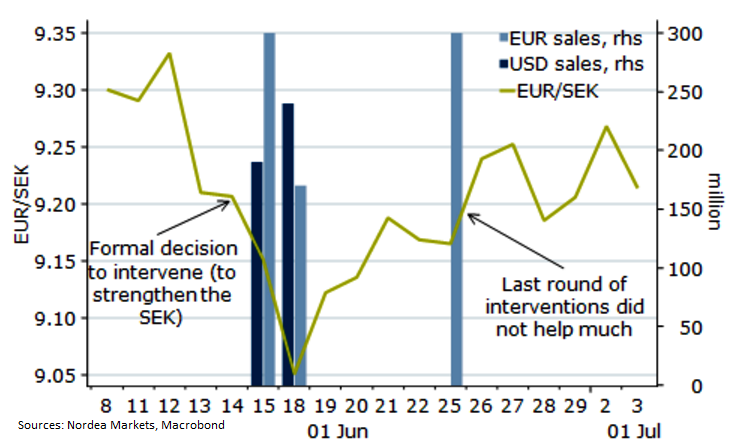

The move was decried by critics who argued that the bank had become too focused on the 2 percent target. Sweden's economic growth has been strong, with GDP expected to have expanded by about 3.7 per cent last year even though inflation has remained low. Market participants also argue that FX interventions often fail. While that may be the case, it surely depends on how the success criterion is formulated.

"Mr Ingves' new powers "truly sad" because currency interventions often fail to bring about the intended result. What it boils down to is that you will erode purchasing power. In the end, it's not beneficial to the country as a whole." said Andreas Wallstrom, economist at lender Nordea

The development of the trade-weighted krona will be crucial. If PBoC lets USD/CNY rise by 15%, this would on its own translate to a SEK gain of at least 1.2% in trade-weighted terms (without discussing spill-over effects on EM Asia, which would be substantial). EUR/SEK was trading at 9.2599 at 1143 GMT down around 0.10 % on the day.

"Currently our best guess is that a KIX level of around 107 would trigger action, but that level will change over time", notes Nordea Research.

SEK 2016 - What could trigger Riksbank's action?

Tuesday, January 12, 2016 12:05 PM UTC

Editor's Picks

- Market Data

Most Popular

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated