Thailand’s gross domestic product (GDP) for the first quarter of this year significantly outperformed the market’s expectations. It increased 4.8 percent y/y (2.0 percent q/q sa). The quarterly rise was the fastest since Q4 2012.

Equally important is that the acceleration was broad-based, putting to rest concerns that Thailand’s recovery is lacking breadth. However, the strengthening growth trajectory is not as yet been accompanied by rising inflationary pressures and therefore, monetary policy can remain accommodative, according to the latest report from ANZ Research.

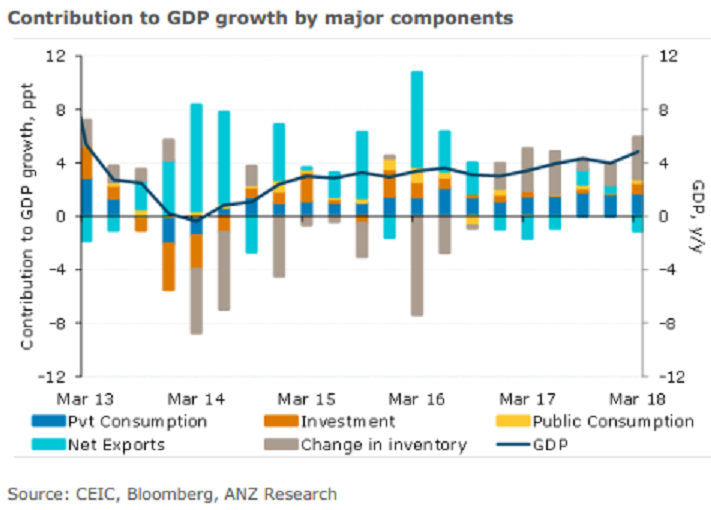

The breadth of the acceleration in growth was the most notable feature of Q1 GDP data. Barring exports which slightly moderated to 6 percent y/y from 7.4 percent y/y previously, all other components accelerated during the quarter. Private consumption strengthened to 3.6 percent y/y from 3.4 percent y/y previously while investment recorded growth of 3.4 percent y/y. For full-year 2017, investment had increased by a meagre 0.9 percent y/y.

From the supply side, agricultural output (including fishing) expanded 6.5 percent y/y, reversing a contraction of 1.3 percent y/y in the previous quarter. This turnaround presumably resulted in higher incomes and consumption in the rural sector. Growth in non-agriculture GDP remained unchanged at 4.7 percent y/y.

"This strong performance has come in an environment of benign inflation, implying that monetary policy can stay accommodative. Thailand’s growth-inflation mix remains favorable," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances