There are the Boxing Day sales, and there was this week’s rush of extremely cashed-up investors desperate to get a slice of this week’s rare 31-year government bond auction.

What’s a bond? What’s a bond auction? We’ll get to those shortly.

First, just know that the government received A$36.8 billion of bids, $20 billion of them within hours of opening the two-day auction on Monday.

It had been wanting to move $15 billion, and could have moved that much again.

$15 billion makes it the third biggest bond sale in Australian history. The two bigger were recent – a $19 billion ten-year bond sale in May and a $17 billion five-year bond sale in July.

Each sale nets the government money it won’t have to pay back for five, ten or 31 years at rates of interest that until recently would have been unthinkably low.

The 31-year bond went for 1.94%. That means the foreign and Australian investors who bought them (including Australian super funds) were prepared to accept less than the usual rate of inflation right through until 2051 in return for regular government-guaranteed interest cheques.

Investors who bought ten year bonds were prepared to accept only 0.92% per year, investors who bought five year bonds, only 0.40%.

What’s a bond?

Even bond traders find it hard to get a handle on what bonds are. In his novel Bombardiers, author Po Bronson writes a scene where a bond trader refuses to work any more and demands to see an actual bond, “any kind of bond”.

He tells his boss he can’t sell bonds “if he’s never seen one”.

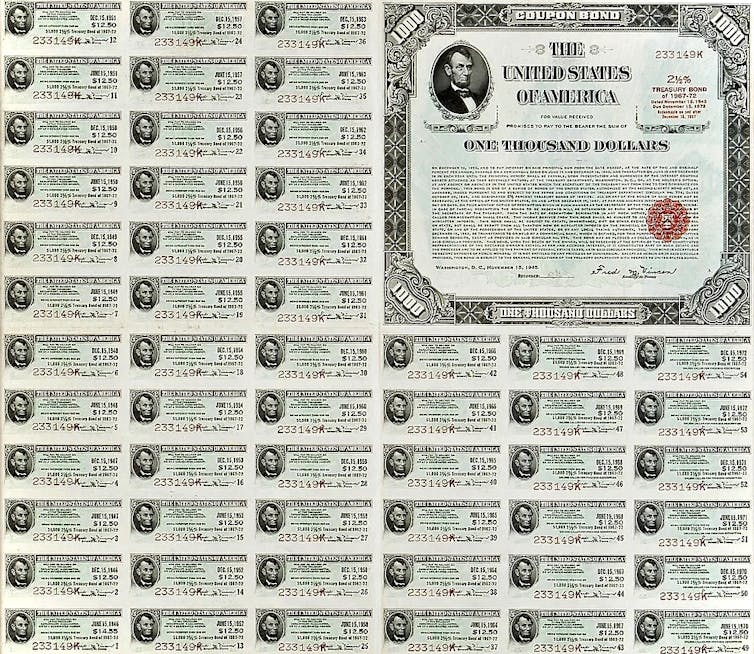

Like many things that used to exist physically, they’re now mainly numbers on screens, but it helps to get a picture.

This one is a US 27-year bond from 1945.

The Joe I. Herbstman Memorial Collection

The biggest part of the paper is a promise to repay the US$1000 it cost, in 27 years time.

The smaller rectangles are called coupons, and each year the owner can tear one off and take it in to get 2.5%.

If the owner wants to sell the bond to someone else (and bonds are traded all the time) it’ll be sold with one coupon missing after one year, two coupons missing after two years, and so on.

When rates fall, prices rise

The price of a bond will vary with what’s happening to interest rates. If they are falling, an existing bond, offering returns at old rates, will become more expensive and can be sold at a profit. If they go up, an existing bond will become worth less and have to be sold at a loss.

It leads to confusion. When bond rates fall, bond prices rise, and visa versa.

For half a decade now bond rates have been falling. They’ve fallen further during the COVID crisis, making bonds a doubly good investment. They offer superannuation funds and others certainty at a time when everything seems uncertain, and if rates continue to fall they increase in value.

It is an indictment of our times that so many investors want them. The government’s office of financial management is going to need to sell an extra $167 billion over the coming year. The rush to buy suggests it could sell more.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran