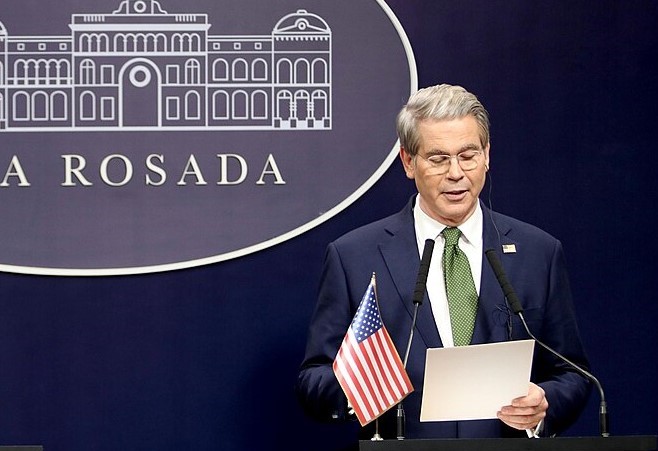

The United States has announced a $20 billion financial support package for Argentina, signaling strong backing for President Javier Milei’s economic reform agenda. U.S. Treasury Secretary Scott Bessent emphasized that the initiative is not a bailout but a strategic investment aimed at stabilizing Argentina’s struggling economy. He stated that the Argentine peso is currently undervalued and that the U.S. is actively purchasing pesos to support its exchange rate, affirming that the existing exchange rate band is appropriate.

Bessent underscored that stabilizing Argentina is a top priority for Washington, describing the move as part of a broader effort to strengthen regional stability and counter rising Chinese influence in Latin America. “We don’t want another failed or China-led state in Latin America,” he remarked, highlighting the geopolitical motivations behind the financial package.

In response, a spokesperson for the Chinese Embassy in Argentina criticized the U.S. approach, urging Washington to focus on genuine development efforts in Latin America and the Caribbean rather than hindering other nations’ cooperation. The spokesperson reiterated that the region is “not anyone’s backyard” and insisted that China’s partnerships with Latin American nations are based on mutual respect and shared growth.

Meanwhile, global trade tensions escalated after former President Donald Trump threatened to impose a “massive increase” in tariffs on Chinese imports. Trump’s warning followed Beijing’s new export controls on rare earth minerals—materials vital to the tech and defense industries. He also hinted that he might cancel his upcoming meeting with Chinese President Xi Jinping amid the rising dispute.

The developments underscore a growing U.S.-China rivalry extending beyond trade into global finance and geopolitical influence, with Argentina now emerging as a key focal point in this power struggle.

New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  U.S. Sanctions on Russia Could Expand as Ukraine Peace Talks Continue, Says Treasury Secretary Bessent

U.S. Sanctions on Russia Could Expand as Ukraine Peace Talks Continue, Says Treasury Secretary Bessent  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns