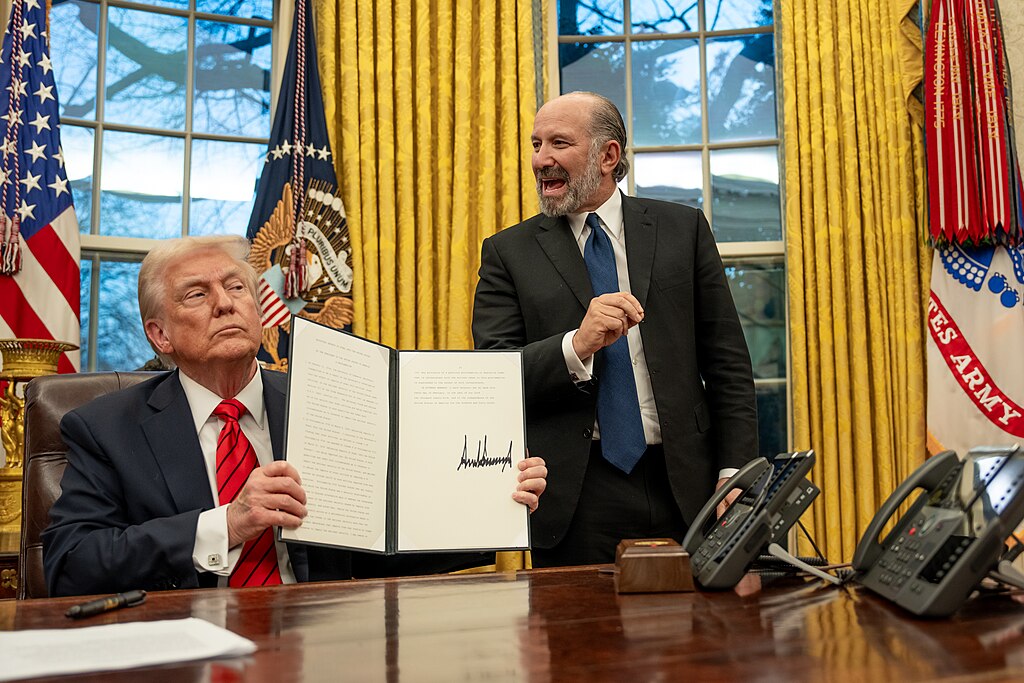

The United States and China have finalized a long-anticipated trade agreement that was initially reached in Geneva last month, according to U.S. Commerce Secretary Howard Lutnick. Speaking with Bloomberg Television, Lutnick confirmed, “That deal was signed and sealed two days ago,” though he did not share further details about its contents.

President Donald Trump also referenced the agreement during a White House event, stating, “We just signed with China yesterday,” without offering additional clarification. The deal is expected to significantly impact global supply chains and bilateral economic ties between the world’s two largest economies.

A key provision in the agreement includes China supplying rare earth materials—essential components for advanced electronics and defense technologies—to the United States. In exchange, the U.S. will lift existing restrictions on ethane exports to China, opening new energy trade channels.

Trump initially announced progress on the deal on June 11 via Truth Social, writing, “Our deal with China is done, subject to final approval with President Xi and me. Full magnets and any necessary rare earths will be supplied, up front, by China. Likewise, we will provide to China what was agreed to... We are getting a total of 55% tariffs, China is getting 10%.”

Lutnick also noted that the U.S. is nearing a separate trade agreement with India, signaling a broader strategy to secure critical resources and improve trade balances.

The U.S.-China deal marks a significant development in the evolving trade relationship between the two nations, especially amid growing global demand for rare earth elements and energy resources. It reflects renewed efforts to stabilize economic cooperation while addressing strategic resource dependencies.

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks