The US will tighten restrictions to prevent Huawei Technologies Co from obtaining semiconductors without a special license, including those made by foreign firms that have been developed or produced with US software or technology.

There would also be another 38 Huawei affiliates in 21 countries added to the US economic blacklist, raising the total to 152 affiliates since May 2019.

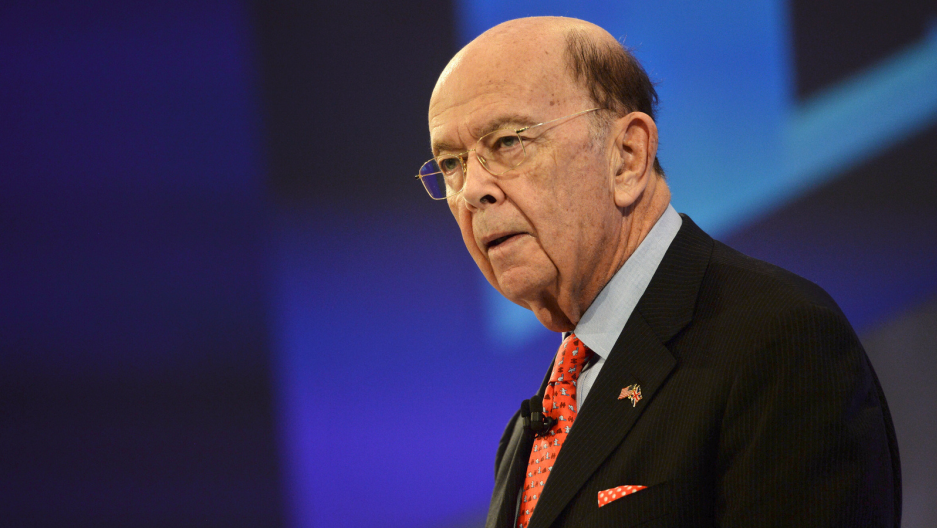

US Commerce Secretary Wilbur Ross said that restrictions on Huawei-designed chips imposed in May prompted "evasive measures" as Chinese firms were "going through third parties."

He emphasized that the use of American software or American fabrication equipment is banned and requires a license.

Secretary of State Mike Pompeo pointed out that they would prevent Huawei from circumventing US law via alternative chip production and off-the-shelf chips."

Ross said they are covering "off-the-shelf designs" that Huawei may purchase from a third-party design house.

Huawei's HiSilicon division relied on US companies such as Cadence Design Systems Inc and Synopsys Inc to design its chips and outsourced the production to Taiwan Semiconductor Manufacturing Co, which uses equipment from US companies.

TSMC has said it will not ship wafers to Huawei after Sept. 15.

A separate rule requires blacklisted companies to obtain a license when a company like Huawei is an intermediate purchaser, end-user, consignee, and ultimate consignee.

The department will not extend a temporary general license that expired Friday for Huawei users, who must now submit license applications for previously-authorized transactions.

However, a limited permanent authorization will be given to Huawei entities to allow security research for maintaining the integrity and reliability of networks and equipment.

The US is persuading governments worldwide to squeeze Huawei out for handing over data to the Chinese government for spying.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals