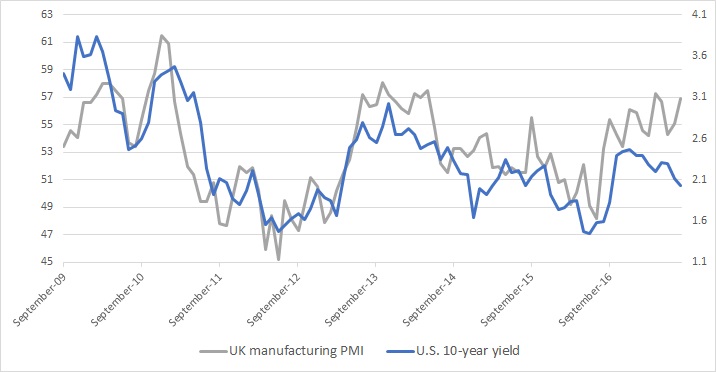

The above four charts show the relation between U.S. 10-year yields and manufacturing PMI numbers from the United States, Switzerland, Eurozone, and United Kingdom. We have chosen U.S treasury as a representative of global yield due to the importance of the U.S. dollar in the global financial system. Even if we had chosen 10-year yield from each region, the outcome wouldn’t be starkly different.

All four charts are showing the close relationship between the manufacturing PMI and 10-year yields, which is not surprising given the fact that central banks do not have much influence on the long term yields, unlike the short-term yields. Long-term yields like 10-years depend on the inflation outlook, state of the economy, savings glut etc.

All four charts have recently been flashing warning signs. A continuing divergence is quite visible for all four charts; extreme for Eurozone. It can be seen that while manufacturing PMI is moving higher, the 10-year treasury yields have been moving lower. For the United States, the divergence began last December and still continuing. For Eurozone, it began back in September 2015. For the UK, the divergence began in 2015, it closed somewhat last year but the gap started widening again since December. For Switzerland, the divergence began December last year and still growing.

While a divergence is n not an all new phenomenon, as can be seen in the chart of U.S. ISM manufacturing PMI and 10-year yields. Back in 2014, a divergence occurred. From March to October 2014, while PMI grew, U.S. treasury yield headed lower. But the divergence collapsed with a slowdown in the economy. So the real question is ‘what will happen this time around? Will yields move higher or will economy slow down?’

RBA Raises Interest Rates to 3.85% as Inflation Pressures Persist

RBA Raises Interest Rates to 3.85% as Inflation Pressures Persist  China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy

China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift

Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand