FxWirePro: A Run Through on VXY for G10 and EMFX-Bloc

Aug 14, 2019 10:18 am UTC| Research & Analysis Central Banks

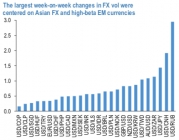

In the recent past, the trade protectionism theme shot back into focus as a potential major left tail risk for markets. Implied and realized volatility has rebounded from low levels driven by general risk-off moves in the...

FxWirePro: SGD FX and Rates Trades on Singapore Q2 GDP Prints and MAS Easing Risks

Aug 13, 2019 14:53 pm UTC| Research & Analysis Central Banks

Singapores final Q2GDP report released this morning was unchanged from the advance report of just 0.1% yoy. The contraction in the manufacturing sector was revised -3.1% yoy vs -3.8% previously but this was offset by...

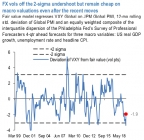

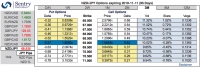

FxWirePro: Post-FOMC and Trade-Tensions’ Effects on FX Vols

Aug 09, 2019 12:41 pm UTC| Research & Analysis Central Banks

The latest tariff threat from Trump emphatically reinforces the perspective of dollars bullishness; the crucial difference for FX volatility is the potential for greater velocity and urgency to dollar rallies than might...

Aug 08, 2019 16:14 pm UTC| Commentary Central Banks

The Philippine central bank, BSP, lowered its Overnight Repurchase Rate by 25 basis points to 4.25 percent today, as was widely anticipated. The BSP cited that prospects for global economic activity are likely to remain...

FxWirePro: A Run Through on LatAm FX-bloc

Aug 08, 2019 14:02 pm UTC| Research & Analysis Central Banks

We also stay long BRL and short MXN, both of which have shown more resilience to external conditions. Reform optimism continues to support BRL, and Brazil- watchers (as well as FinMin Guedes) have shifted their focus to...

FxWirePro: Fed’s latest rhetoric and its impact on FX derivatives market

Aug 08, 2019 11:46 am UTC| Research & Analysis Central Banks

Both shocks this week an insufficiently dovish Powell and the re-escalation of tariffs reinforce a defensive stance of favoring safe currencies and the dollar against high-beta FX. A sudden tariff escalation suggests...

Aug 08, 2019 08:22 am UTC| Research & Analysis Central Banks

The RBNZ has cut OCR rates by 50 bps in its monetary policy to keep OCR at 1.00% which was more than the consensus, markets expected only 25bps. The Kiwis central bank has demonstrated its willingness to take bold...

- Market Data