FxWirePro: The Day Ahead-31st July 2019

Jul 31, 2019 04:29 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Data and events so far: China: Manufacturing PMI rose to 49.7 in July. Non-manufacturing PMI declined to 53.7...

FxWirePro: Bid 3m CAD/JPY IV Skews and Deploy Options Strips on Status-quo BoJ

Jul 30, 2019 11:45 am UTC| Research & Analysis Central Banks

We should give a mention to the Bank of Japans (BoJ) rate meeting. Even though the central bank council did not decide on any new measures it cannot ignore the global tendency towards more expansionary monetary policy,...

BOJ monetary policy: Assessing future bias

Jul 30, 2019 06:54 am UTC| Commentary Central Banks

At todays meeting, policymakers at the Bank of Japan (BoJ) kept the policy unchanged, and the benchmark interest rate at -0.1 percent in 7-2 votes. Lets look at the current monetary policies, Bank of Japan had...

Jul 30, 2019 01:36 am UTC| Commentary Central Banks

Bank of Japan (BOJ) will announce its monetary policy decisions today sometime in early Asian hours, probably around 2:00 GMT, followed by a press conference from Governor Kuroda around 6:30 GMT. Current monetary policy...

FxWirePro: Take a look at CBR’s rate cuts and USD/RUB options trades

Jul 29, 2019 13:20 pm UTC| Research & Analysis Central Banks

As expected, the Russian central bank (CBR) lowered its key rate by 25bp to 7.25% on Friday. It has already lowered its inflation outlook considerably in June: for the end of 2019, it expects an inflation rate of 4.2-4.7%,...

FxWirePro: A Run Through on Scandinavian FX Valuations and Trade Recommendations

Jul 29, 2019 13:07 pm UTC| Research & Analysis Central Banks

NOKs lagging performance despite a wider rate differential is explained by crude prices. Assuming usual betas relative to oil, one could argue that EURNOK should have remained range-bound, yet the cross has drifted lower...

Fundamentals to watch out for this week

Jul 29, 2019 11:44 am UTC| Commentary Central Banks

In terms of volatility risks, this week is heavy with the focus of central banks and geopolitics, What to watch for over the coming days: Central Banks: Bank of Japan (BoJ) will announce the monetary policy...

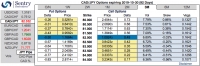

- Market Data