FxWirePro: The Day Ahead- 24th June 2019

Jun 24, 2019 03:47 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, and all with low to medium volatility risks associated. Upcoming: Japan: Leading economic and coincident index reports will be published at 5:00 GMT....

Japanification: ECB to cut deposit rate this year, chances of QE restart seemingly high

Jun 21, 2019 09:06 am UTC| Commentary Economy Central Banks

The European Central Bank is more likely to cut the deposit rate this year in an effort to move the stubborn inflation, which the central bank failed to push decisively higher despite unprecedented stimulus. While euro...

FxWirePro: The Day Ahead- 20th June 2019

Jun 21, 2019 04:41 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, but all with low to medium volatility risks associated. Data and events so far: Japan: Nikkei flash PM down to 49.5 in June from 49.8...

Why Federal Reserve independence matters

Jun 21, 2019 01:42 am UTC| Insights & Views Central Banks Economy

Should you care if the Federal Reserve loses its independence? Its become a growing risk in recent years as President Donald Trump has repeatedly attacked the U.S. central bank over interest rate policy and tried to...

FxWirePro: Monetary policy stimulus most prevalent in Asia – Uphold KRW vols spread

Jun 20, 2019 13:39 pm UTC| Research & Analysis Central Banks Insights & Views

The Reserve Bank of India (RBI) cut rates as widely expected for the third consecutive meeting by 25bp to 5.75% and shifted to a dovish bias. When Governor Das lowered rates in February this year, he was accused of...

Norges Bank hikes interest rate by 25 bps, hints at another hike in September

Jun 20, 2019 13:06 pm UTC| Commentary Central Banks

The Norwegian central bank, Norges Bank, hiked the interest rates today and imply that it might tighten the monetary policy further. As was anticipated, Norges Bank hiked the key rate to 1.25 percent. The central bank...

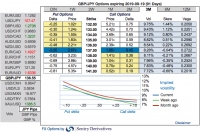

FxWirePro: Load up ATM delta puts on GBP/JPY as hard time for British pound on cards ahead of BoE

Jun 20, 2019 11:12 am UTC| Research & Analysis Central Banks

It was primarily the Brexit that cast its shadow over the Bank of Englands monetary policy so far. The central bank had clearly signaled that normalization of its monetary policy over the medium term depended on an...

- Market Data