RBA likely to cut Cash Rate by 25bp in August and November, says ANZ Research

Jun 10, 2019 02:28 am UTC| Commentary Central Banks Economy

The Reserve Bank of Australia (RBA) is expected to cut the benchmark Cash Rate by 25 basis point at its monetary policy meetings in August and November, taking the rate to 0.75 percent by end of this year, according to a...

The Reserve Bank will cut rates again and again, until we lift spending and push up prices

Jun 07, 2019 16:11 pm UTC| Insights & Views Central Banks

The Reserve Bank cut interest rates on Tuesday because we arent spending or pushing up prices at anything like the rate it would like. And things are even worse than it might have realised. As the board met in Martin...

Fundamental Evaluation Series: NZD/USD vs. 2-year yield spread

Jun 07, 2019 11:30 am UTC| Commentary Central Banks

The chart above shows, how the relationship between NZD/USD and 2-year yield divergence has unfolded since 2015. While the spread has narrowed steadily from +300 basis points (bps) in January 2015 to -106 bps as of...

Fundamental Evaluation Series: AUD/USD vs. 2-year yield spread

Jun 07, 2019 11:25 am UTC| Commentary Central Banks

The chart above shows, how the relationship between AUD/USD and 2-year yield divergence has unfolded since 2012. The chart above makes a clear case of closeness between the rate spread and the exchange rate. The spread...

Jun 07, 2019 10:09 am UTC| Research & Analysis Central Banks

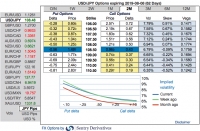

USDJPY OTC update and options strategy as follows: Please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 106.00 levels....

Jun 07, 2019 05:34 am UTC| Commentary Central Banks Economy

The emerging market Asian central banks are expected to maintain a pro-growth stance amid hovering external uncertainty, according to the latest research report from Scotiabank. Fed Chairman Jerome Powell said on...

FxWirePro: ECB monetary policy preview

Jun 06, 2019 10:38 am UTC| Commentary Central Banks

Today European Central Bank (ECB) is to provide further guidance in policy meet. Result to be announced at 11:45 GMT, followed by a press conference at 12:30 GMT. The meeting is to be held at the ECB headquarter in...

- Market Data