RBI strengthens tools to address problems at struggling banks - Fitch

Apr 20, 2017 14:15 pm UTC| Commentary Central Banks Economy

The Reserve Bank of India (RBI) has tightened the thresholds for capital ratios, NPLs, profitability and leverage - at which banks enter the prompt corrective action (PCA) framework. The move could suggest a greater...

PBoC lifts curb on outbound renminbi payments as outflows pressure eases

Apr 20, 2017 13:59 pm UTC| Commentary Central Banks Economy

The Peoples bank of China (PBoC) has scrapped a restriction on cross-border capital movement imposed in January as outflows pressure eases. This was the first concrete move to loosen capital controls since authorities...

Apr 20, 2017 05:37 am UTC| Central Banks Insights & Views

BoE governor Mark Carney is scheduled to deliver a speech, usually, as head of the central bank, which controls short-term interest rates, he has more influence over the nations currency value than any other person....

Apr 19, 2017 17:31 pm UTC| Central Banks

The USD/CAD pair rose on Wednesday as fall in oil prices and stronger greenback across the board weighted on the commodity-linked Canadian dollar. Oil slid more than 1 percent on Wednesday after U.S. data showed a...

Apr 19, 2017 11:51 am UTC| Insights & Views Central Banks

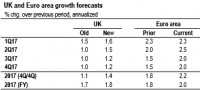

The UK has been entering a phase of relative growth underperformance. A stronger global backdrop is benefiting the UK, prompting us to revise up 2017 GDP growth this week. But the fundamentals driving domestic demand...

Bank Negara Malaysia to look through inflation surge, likely to hold key policy rate at 3 percent

Apr 19, 2017 11:49 am UTC| Insights & Views Economy Central Banks

Malaysias consumer price inflation hit an eight-year high in March, data released by the Malaysian statistics department showed on Wednesday. Malaysias headline inflation accelerated to 5.1 percent in March, from 4.5...

Apr 19, 2017 11:23 am UTC| Commentary Central Banks Economy

The Reserve Bank of India (RBI) is expected to remain firmly in a neutral mode throughout 2017, owing to sticky core inflation and its focus on meeting its 4 percent CPI inflation target for March 2018. In its April...

- Market Data