Dec 23, 2016 11:20 am UTC| Central Banks Research & Analysis Insights & Views

The momentum remains negative, the next target 0.7145 (May low). AUDUSD 1-3 month:Foresee potential below 0.7200 up to 0.70 levels. The US dollar has had an impressive rise since the US election and has apotential to...

Fed Hike Aftermath Series: Market not convinced of three rate hikes in 2017

Dec 23, 2016 10:57 am UTC| Commentary Central Banks

In its last monetary policy forecast, the Federal reserve has projected three rate hikes in 2017 but that is quite an upgrade given the facts that the FED has raised rates only twice over the past two years. In both 2015...

ECB's Weidmann says bank shouldn't delay hike rates

Dec 22, 2016 14:58 pm UTC| Commentary Central Banks

ECBs governing council member and Bundesbank Chief Jens Weidmann called for the central bank to prevent undue delays in hiking rates. In an interview in German WIWO, Weidmann noted that the central bank shouldnt leave it...

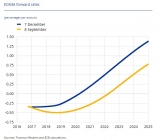

Chart of the Day: EONIA forward

Dec 22, 2016 14:45 pm UTC| Commentary Central Banks

Euro Overnight Index Average, popularly known as EONIA steepened after US election. Back in September, EONIA was pricing the ECB rate to remain below zero till 2022, but in December it is pricing a zero rate until...

Weidman worries inflation; calls for ECB to not to fear hikes

Dec 22, 2016 13:37 pm UTC| Commentary Central Banks

According to the German Bundesbank chief Jens Weidman, the European Central Bank (ECB) is running the risk of keeping monetary policy too loose in the face of higher inflation. Mr. Weidman, who voted against additional...

BoT likely to remain on hold through 2017, growth prospects remain muted

Dec 22, 2016 12:27 pm UTC| Commentary Central Banks Economy

The Bank of Thailand (BoT) is expected to remain on hold through 2017. As widely expected, the central bank left rates unchanged at 1.5 percent for the 13th straight meeting Wednesday. The economy faces increasing downside...

FxWirePro: Can BRL withstand BCB’s 50 bps cuts? Shorting USD/BRL gamma in calendar spreads to answer

Dec 22, 2016 11:56 am UTC| Central Banks Research & Analysis Insights & Views

This write up is to emphasize BRLs exposures and keep it safe with optimal hedging vehicles amid intensifying speculation of Brazilian central banks rate cuts. How will monetary policy in Brazil develop next year? It...

- Market Data