US housing starts and building permits bettered estimates in June, revive hopes for Fed hike in 2016

Jul 20, 2016 10:55 am UTC| Insights & Views Economy Central Banks

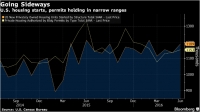

US Commerce Department data showed on Tuesday that new-home construction in the U.S. rose more than forecast in June, a sign that demand for housing continues to firm heading into the second half of the year. Housing...

Bank Indonesia likely to lower interest rate during policy meeting

Jul 20, 2016 06:41 am UTC| Commentary Central Banks

The Indonesian central bank, Bank Indonesia, is likely to lower its key policy rate again on Thursday after pausing for a short period following three consecutive rate reductions. BI is expected to lower rate as a...

CBRT lowers upper end of overnight rate corridor by 25bps

Jul 19, 2016 12:35 pm UTC| Commentary Central Banks

The Turkish central banks Monetary Policy Committee on Tuesday decided to lower the upper end of its overnight corridor the overnight lending rate - by 25 basis points to 8.75 percent. This was CBRTs fifth straight rate...

Central Bank of Brazil likely to keep rates on hold; statement to hint at easing in August

Jul 19, 2016 12:22 pm UTC| Commentary Central Banks

The Central Bank of Brazil is unlikely to change its rate in July; however, copomstatement is expected to signal at easing in August. The remarks of new central bank President Ilan Goldfajn have been more hawkish than...

What hinders CAD prospects and what intensifies sterling's depreciation sentiments?

Jul 19, 2016 11:52 am UTC| Central Banks Insights & Views

Just to shed some light on fundamentals as to why CAD losing strength: This months BoC policy statement, monetary policy report and quarterly press conference establish a firm neutral stance that will reinforce the...

Jul 19, 2016 11:50 am UTC| Central Banks Insights & Views

FX Option Strategy: Here comes the right option strategy to tackle puzzling swings of GBPCAD, put spread constructed at net credits, buy mid-month +1% Out of the money -0.37 delta put option, simultaneously, short 1W...

Riksbank concerned about global developments post Brexit vote

Jul 19, 2016 11:23 am UTC| Commentary Central Banks

The minutes from Riksbanks monetary policy meeting on July 6 indicate that it is concerned about global developments post UKs vote to leave the EU. The minutes also showed that it is quite satisfied with the developments...

- Market Data