CNY-CNH spread could narrow on SDR discussion

Sep 28, 2015 07:24 am UTC| Commentary

After U.S. President Barack Obama and Chinese President Xi Jinping met Friday in Washington, the two sides issued a statement saying the U.S. supports the inclusion of the Chinese renminbi (RMB) in the IMFs SDR (Special...

South Korea's export weakness to continue, imports to fall further in September

Sep 28, 2015 07:11 am UTC| Commentary

South Koreas weakness in exports is likely to continue in September, with only a modest recovery from the significant decline in August. Based on interim data up to 20 September, it is forecasted that exports will rise...

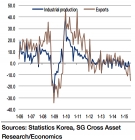

South Korea's IP likely fell further in August as exports contract significantly

Sep 28, 2015 07:07 am UTC| Commentary

South Koreas Trade data show that exports contracted from $46.6bn in July to $39.2bn in August, though this was partially driven by the cancellation of a delivery in the shipbuilding sector that is unrelated to production...

India likely to increase fiscal expenditures during FY 15-16

Sep 28, 2015 07:01 am UTC| Commentary

Indias fiscal policy is turning more growth-supportive, in sharp contrast to the past four years of deficit compression and austerity. Given the revenue boost from rising indirect tax receipts (+35.3% y/y fiscal YTD),...

Australian supermarket price war effect likely to fade

Sep 28, 2015 07:00 am UTC| Commentary

Australias recent retail sales data were definitely on the soft side, with average monthly gains of 0.2% over the five months to July, which is exactly half the average pace recorded in 2013/14. This weakness stems in...

Australia's credit growth likely stabilising at a healthy rate

Sep 28, 2015 06:53 am UTC| Commentary

The sharp slowdown in Australias credit growth in July to 0.6% mom from an average of 0.9% mom over the previous 12 months looks to us erratically weak. Underlying growth momentum in Australias private sector credit is...

Furher rate cuts likely from PBoC this year

Sep 28, 2015 06:46 am UTC| Commentary

Despite the financial market turmoil, a soft landing is still seen as the most plausible scenario in the coming two years. Chinese growth will continue falling due to structural constraints such as a shrinking labour...

- Market Data