Japan needs expansion of nominal GDP through reflationary policies

Sep 29, 2015 04:40 am UTC| Commentary Economy

The original goal of Abenomics was to expand nominal GDP through reflationary policies, as it perceived shrinking nominal GDP to be the largest problem facing the Japanese economy. This policy is leading Japan in the right...

Currency weakness driving MYR rates higher

Sep 29, 2015 04:30 am UTC| Commentary

MYR market rates have been under upward pressure in recent weeks amid ongoing political challenges and a protracted period of depressed oil prices. Notably, the 3M Klibor has also inched up to 3.74% after staying stable at...

Daily Economic Outlook: 29th September, 2015

Sep 29, 2015 04:24 am UTC| Commentary

The recovery in mortgage approvals for house purchases during 2015 has been underpinned by rising new buyer enquiries, real earnings growth, and consumer confidence. These ongoing developments, alongside an August increase...

US consumer spending picks up speed in August

Sep 29, 2015 04:05 am UTC| Commentary

US economic recovery is continued to be driven by US consumer spending. Financial volatility picked up in August, but this appears to have done little to dent consumer sentiment and spending. The gains in August were...

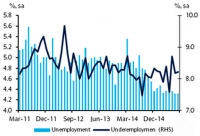

Mexico likely to reach full employment by H2 2016

Sep 29, 2015 03:47 am UTC| Commentary

With respect to the unemployment rate observed in July, Mexicos August unemployment rate remained flat. An unexpected increase in the participation rate of almost 80bp mainly drove this in seasonally adjusted data reaching...

Chinese Reminbi regime change, US fiscal standoff

Sep 29, 2015 03:42 am UTC| Commentary Central Banks

There are two specific political/policy uncertainties which could serve as another deterrent for the Fed, even if the data evolves as expected. In China, the uncertainty around the RMB is an important risk factor. PBoC is...

US domestic strength to outweigh external weakness

Sep 29, 2015 03:33 am UTC| Commentary

US Fed will want to see confirmation that the slowdown in China had no material spill-over effects, either via the dollar, commodity prices or broader financial conditions. This is likely the case before year-end. The...

- Market Data