Timing of Fed tightening may influence Banxico decision

Jul 30, 2015 07:16 am UTC| Commentary

The Bank of Mexico has kept its policy rate unchanged since mid-2014 at its lowest level of 3.0%.Societe Generale states the timing of the beginning of the Feds tightening cycle, which could increase financial market...

CNB most probably intervened yesterday

Jul 30, 2015 07:04 am UTC| Commentary

Rising straight to 27.10, EUR-CZK jumped sharply during the European session yesterday, the price action strongly hints at intervention by CNB.The CB has acknowledged intervening in the FX market to weaken the koruna, but...

Russian central bank stops RUB sales

Jul 30, 2015 06:58 am UTC| Commentary

The ruble appreciated for a change yesterday, having faced a lot of headwind recently and having come under strong pressure against EUR and USD, i.e. a downmove in EUR-RUB and USD-RUB. Of course well versed market...

Banxico to stay on pause until Q1 16

Jul 30, 2015 06:55 am UTC| Commentary

The Bank of Mexico has kept its policy rate unchanged since mid-2014 at 3.0%, which is its lowest level.According to Societe Generale, no rate hikes are expected until Q1 2016 due to the persistent output gap and low...

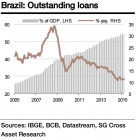

Brazil's credit growth deceleration likely continued in June

Jul 30, 2015 06:22 am UTC| Commentary

After a brief pick-up in H2 14 on liquidity measures, Brazils credit growth resumed its decelerating trend. In fact, credit growth has been on a decelerating trend since the end of 2010 and it would be difficult to expect...

US real business activity likely sprang back during the spring

Jul 30, 2015 06:12 am UTC| Commentary

US real GDP and real consumption spending data for Q2 is scheduled to release today. These two macroeconomic indicators recorded -0.2% and 2.1% growth respectively in Q1. Societe Generale estimates, the real GDP growth is...

Australia's credit growth stabilizing at a respectable rate

Jul 30, 2015 06:04 am UTC| Commentary

The current rate of Australias credit growth is charecterized by RBA as "moderate", and from a purely historical perspective this is correct. However, the 6-plus percent rate to be rather strong, it is well above nominal...

- Market Data