UK GDP growth to bounce to 0.6% qoq in Q2

Jul 27, 2015 12:38 pm UTC| Commentary

UK GDP data will be released tomorrow. The eoconomy is expected to post higher growth rate than previous period.The weakness of growth in Q1 of only 0.4% qoq was mainly caused by the surprise fall in services output growth...

France consumer spending to recover in June

Jul 27, 2015 12:30 pm UTC| Commentary

France consumer spending data is expected to realese on Friday. The country posted 0.1 mom growth in consumer spending in May.The French National Statistical Institute (INSEE) is expected to report that consumer spending...

Flash German HICP inflation to print at 0.2% yoy

Jul 27, 2015 12:22 pm UTC| Commentary

Flash German HICP declined sharply from 0.7% yoy in May to 0.1% yoy in June.According to Societe Generale, "The HICP index is expected to recover 0.2% yoy in July, says Societe Generale. The weak energy prices is likely to...

Improvement likely in EC economic indicators for July

Jul 27, 2015 10:00 am UTC| Commentary

European Commissions economic confidence indicator was 103.5 in June. Despite the softening in both the manufacturing and services flash PMIs for July released last week, it is expected to improve to 104.1 in July since...

Euro eases from daily highs, breaks below $1.1070

Jul 27, 2015 09:28 am UTC| Commentary

The euro rallied more than 100 pips after the open, further supported by an upbeat German IFO survey and weakness in the US dollar. The headline IFO Business Climate Index came in at 108 points during the seventh month of...

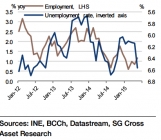

Chile's unemployment rate likely increased in June

Jul 27, 2015 09:22 am UTC| Commentary

The continued weakness in Chiles trade data shows that both the domestic economy and the external demand environment have yet to show any sign of revival.As a result, and despite the fact that significant fiscal spending...

Improvement in BRL outlook crucial to stabilise inflation and rate expectations

Jul 27, 2015 09:16 am UTC| Commentary

While a significantly high Selic rate could theoretically help the BRL to stabilise and inflation to normalise, things are not all going to be that easy in the above-mentioned macro/fiscal scenario.Its not even clear if...

- Market Data