Jul 27, 2015 23:54 pm UTC| Commentary

On Tuesday at 09:30 Britain will release Q2 GDP estimates, with Sterling likely to rally against the Euro if a strong report supports BOE Governor Mark Carneys recent hawkish comments about future rate hikes. Analysts...

Jul 27, 2015 23:51 pm UTC| Commentary

The US dollar has run over a number of currencies from the commodity and emerging world in recent days as worrying Chinese headlines hit those currencies. However, the dollars appreciation against the Euro and Sterling has...

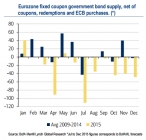

DM rates: What’s different in 2015: ECB, liquidity & corporate supply

Jul 27, 2015 23:36 pm UTC| Commentary

BofA Merrill Lynch notes: Seasonal patterns are usually best left to the numbers without second guessing with macro rationale. Nevertheless, there are two reasons why we think the impact could be exaggerated this year...

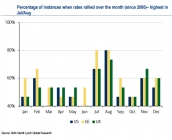

DM rates: As you debate the macro, don’t forget the micro

Jul 27, 2015 23:20 pm UTC| Commentary

BofA Merrill Lynch notes:As developed market rates stay elevated following the Q2 selloff, the macro arguments for both higher (better DM growth data, Greece resolution, approaching Fed hike) and lower yields (declining...

EUR outperforms, helped by a better than expected German IFO survey

Jul 27, 2015 22:48 pm UTC| Commentary

RBC Capital Markets notes:EUR was already trading higher, but was given an additional leg up by Julys German Ifo survey (o/n high 1.1130). The headline index came in at 108.0 (consensus 107.2), breaking a run of three...

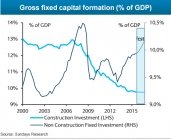

Euro area GDP to grow slightly above trend

Jul 27, 2015 22:20 pm UTC| Commentary

Barclays notes:The euro area economy is still on track for a modest recovery in 2015; we expect GDP to grow by 1.4% this year and 1.6% next year, ie, slightly above trend.We do not expect economic activity to accelerate...

Euro area: Monetary policy on hold with an easing bias

Jul 27, 2015 21:37 pm UTC| Commentary

Barclays notes:Since the ECB launched its asset purchase programme in March, the Governing Council has remained cautiously optimistic about its potential effect. Our financial conditions index suggests that despite a...

- Market Data