Nov 06, 2015 15:02 pm UTC| Insights & Views

Energy pack is trading in red. Weekly performance at a glance in chart table. Oil (WTI) - WTI reversing gains over stronger NFP report. Todays range $44.5-45.7 WTI is currently trading at $44.8/barrel. Immediate...

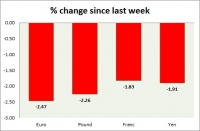

Currency snapshot (major pairs)

Nov 06, 2015 14:57 pm UTC| Insights & Views

Dollar index trading at 99.22 (+1.27%). Strength meter (today so far) - Euro -1.44%, Franc -1.01%, Yen -1.01%, GBP -0.91% Strength meter (since last week) - Euro -2.47%, Franc -1.83%, Yen -1.91%, GBP -2.26% EUR/USD...

What to make of the payroll report and Dollar –

Nov 06, 2015 13:50 pm UTC| Insights & Views

As expected US payroll data added massive volatility in the market. Gain was massive. Euro went down more than 150 points against Dollar, currently trading at 1.074 against Dollar. Pound after all days fall, down...

FxWirePro: Kiwi/Dollar outlook – Downside remains open

Nov 06, 2015 13:24 pm UTC| Insights & Views

Recent big rally in New Zealand Dollar might be over with Wednesdays wedge break and the pair (NZD/USD) might slide further with speculation over December rate hike from US Federal Reserve. Milk which is most vital...

FxWirePro: Dollar/Yen outlook – further upside likely

Nov 06, 2015 13:02 pm UTC| Insights & Views

Over the past months, Yen hasnt been a great pair to trade with policy divergence outlook as it kept on gaining from time to time, riding on risk aversion. Moreover, no further easing from Bank of Japan (BOJ) has been...

NFP report preview – all about headline

Nov 06, 2015 12:26 pm UTC| Insights & Views

Today NFP report is to be published at 13:30 GMT from US. What is NFP report? NFP or non-farm payroll report is the monthly statistics on labor condition in the US released by US department of labor statistics. The...

Is Chinese stock market crash over? – Part 2

Nov 06, 2015 11:52 am UTC| Insights & Views

In previous part released yesterday, we asked if the crash is over sighting technical sign that Chinese benchmark stock index is up 20% from August low, which is an indicator for bull market but pointed out that Chinese...

- Market Data