UK house prices drop should be welcomed

Oct 06, 2015 11:35 am UTC| Insights & Views

In a city, where living below the staircases, with space of just a man to lie down costs 500 per month, a marginal house prices there should be welcomed broadly rather than seeing it as signs of slowdown. I hope you are...

FED holding ZRP well into 2016 plausible, says Goldman Sachs

Oct 06, 2015 11:28 am UTC| Insights & Views Central Banks

According to prominent US investment bank Goldman Sachs there may be good reason for FED to keep interest rates on hold well into 2016 and potentially beyond. The risks have grown of not a short time delay but longer...

BoE to stand pat, more comments likely about China

Oct 06, 2015 11:09 am UTC| Insights & Views Central Banks

The Bank of Englands official interest rate has been at 0.5 percent since March 2009. The BoE is largely expected to leave policy unchanged when it meets on Thursday, Oct 8th, and the vote should be a repeat of last months...

US corporates suffering stronger Dollar headache, SAB-miller edition

Oct 06, 2015 10:51 am UTC| Insights & Views

Brewer SABMiller, which is worlds second largest in terms of market share and is the target of takeover interest from its bigger rival Anheuser-Busch InBev, has reported its second quarter results which clearly shows the...

What could prop up or hinder Euro? Pros and cons of EUR/USD ahead of Fed’s meet

Oct 06, 2015 10:42 am UTC| Insights & Views

This pair falls in the middle/lower half of the 1.08-1.15 range that has broadly held since May (except for the extreme illiquid/risk off conditions on August 24-25). EUR is trapped between several opposing forces at...

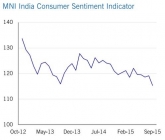

Indian consumer sentiment drops to 3-year low

Oct 06, 2015 09:50 am UTC| Insights & Views

While global investors are optimistic over India, its consumers are not. While new government in the center pursuing policies that are beneficial to businesses are not so well for Indian consumers. Recently Indian...

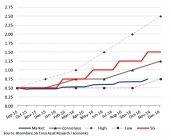

Oct 06, 2015 09:06 am UTC| Insights & Views Central Banks

Reserve bank of Australia (RBA), chose to keep policy rates on hold, in spite of continued weakness in the economy arising from commodity shock and slower import demand from China for Australias hard commodities such as...

- Market Data