Commodities snapshot (precious & industrial)

Sep 29, 2015 15:55 pm UTC| Insights & Views

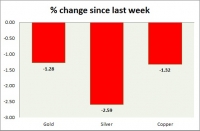

Metal pack is mixed in todays trading. Performance this week at a glance in chart table - Gold - Gold recovered after sharp initial drop. Todays range - $1135-$1124 Gold is currently trading at $1131/troy ounce....

Currency snapshot (major pairs)

Sep 29, 2015 15:02 pm UTC| Insights & Views

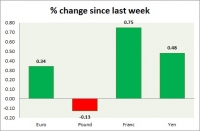

Dollar index trading at 96.10 (+0.10%). Strength meter (today so far) - Euro -0.01%, Franc +0.35%, Yen -0.14%, GBP -0.06% Strength meter (since last week) - Euro +0.34%, Franc +0.75%, Yen +0.48%, GBP -0.13% EUR/USD...

Euro’s sensitivity to German inflation data shows expectation build up for further easing

Sep 29, 2015 14:21 pm UTC| Insights & Views

Euros move down over German CPI data shows that expectations for further easing by European Central Bank is clearly building up, which might dominate Euro over the coming weeks and months. Preliminary reading showed...

Risk trade review in light of Yen’s triangular consolidation

Sep 29, 2015 13:38 pm UTC| Insights & Views Technicals

Yen is known for its liquidity and safe haven status in financial world. Anyone who is a bit familiar with financial market knows, how suddenly and fast Yen could outpace almost all asset class in return in time of heavy...

FxWirePro: Hedging framework for vulnerable BRL

Sep 29, 2015 13:28 pm UTC| Insights & Views

Brazils worsening fiscal outcomes amid slowing growth is being perceived as implying tolerance for higher inflation. BRL weakness has happened alongside higher breakevens, but it still looks expensive adjusted for credit...

FXWirePro: Korea capitalizing trade surplus despite Chinese slowdown – 6M forwards for hedging

Sep 29, 2015 13:24 pm UTC| Insights & Views

Although some currencies have weakened sharply due to global slowdown especially China, all EM FX do not appear to have overshot. EM Asia FX will face the brunt of slowing Chinese growth and a weaker CNY. Korea and Taiwan...

Japanese Nikkei wipes out all of 2015 gains

Sep 29, 2015 12:43 pm UTC| Insights & Views

Nikkei has wiped out all of their 2015 gains, with more than 4% drop today. China is Japans one of the largest trading partner and with the former slowing down, appeal for Japanese stocks are waning. Moreover last week,...

- Market Data