Emerging market crisis series – Japan a big victim

Sep 14, 2015 12:02 pm UTC| Insights & Views

Emerging market (EM) crisis and falling values of EM currencies have started taking toll on Japan and Bank of Japans (BOJ) monetary policy. Japans borrowing cost was already at historical low, when Bank of Japan (BOJ)...

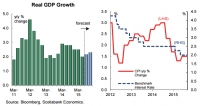

Australia's growth to expand this year, monetary conditions to remain accommodative

Sep 14, 2015 11:40 am UTC| Insights & Views Central Banks

The Reserve Bank of Australia remains optimistic about prospects for the economy. The central bank said last week that both record-low interest rates and a weaker Australian dollar were helping to support modest growth....

BOJ likely to hold policy tomorrow

Sep 14, 2015 11:01 am UTC| Insights & Views

Bank of Japan (BOJ) will announce its monetary policy decisions tomorrow sometime in early Asian hours. Speech by Governor Kuroda is expected to be scheduled at 3:00 GMT. Current monetary policy - BOJ is holding policy...

QE plus more likely from ECB than taper – Part 2

Sep 14, 2015 10:32 am UTC| Insights & Views

In previous part of QE plus more likely from ECB than taper I introduced the idea back in July, sighting high unemployment in the region. Check out the article at...

FxWirePro: WTI crude prices still fragile; PRBS to arrest extended potential dips

Sep 14, 2015 10:09 am UTC| Insights & Views

US crude inventory level checks have reduced to 2.6 million from previous 4.7 millions but this upbeat number exceeded forecasts (0.9 million); as a result crude has shown a little surge in its price. WTI crude futures...

Euro area Industrial production shows strength, still way below normal

Sep 14, 2015 09:49 am UTC| Insights & Views

Euro area industrial production has beaten estimates for July, growing 0.6% from June, while median expectation was just about 0.2%. Industrial production probably picked up in July, as concerns over Greece had started...

Sep 14, 2015 09:10 am UTC| Insights & Views

CFTC commitment of traders report was released on Friday (8th September) and cover positions up to Tuesday (11th September). COT report is not a complete presenter of entire market positions, since future market is...

- Market Data