Sep 14, 2015 15:30 pm UTC| Insights & Views

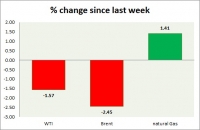

Energy pack is in mixed today, while oil is in red, gas is trading in green. Weekly performance at a glance in chart table. Oil (WTI) - WTI dropped today as it keep finding sellers at rallies, now on its way to test...

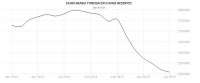

Smelling a peg break series – strain on Saudi Arabia

Sep 14, 2015 14:59 pm UTC| Insights & Views

Saudi Arabia is pumping crude at record pace in its bid to protect its market share, especially in Asia, and to push high cost producers out of the oil market. However, its strategy at one hand to pump crude at record...

Forecast for Brazil gets worse

Sep 14, 2015 14:07 pm UTC| Insights & Views

According to latest survey by Brazils central bank of hundreds of analysts shows that they not only expects Brazils economy to contract both in 2015 and 2016 but contraction to be much steeper. Economists are now...

Who really benefits from deepening deflation in India?

Sep 14, 2015 13:24 pm UTC| Insights & Views

Latest data showed deflation deepened in India, with wholesale prices dropping by -4.95% compared to a year ago. This is 10th consecutive month of deflation. Price drop has pushed Reserve Bank of India to cut rates for...

Kiwi dollar adamant to give up 6-year lows, Chinese spillover effects adding downside pressures

Sep 14, 2015 12:50 pm UTC| Insights & Views

In our earlier posts we described leading technical indicators tend to signal NZD/USD could have trend reversal but the Chinese slowdown not only had a direct impact, in terms of the export of Kiwis dairy products and in...

Non-OPEC oil growth to slow down fast

Sep 14, 2015 12:47 pm UTC| Insights & Views

According to latest report from OPEC, oil production outside OPEC is likely to slow down fast going ahead as Saudi Arabia led OPECs strategy to overproduce the market to keep oil price low and force high cost producers out...

FxWirePro: Gold lackluster buying interest ahead of Fed’s event – derivative updates

Sep 14, 2015 12:39 pm UTC| Insights & Views

From the above table you can observe the delta risk reversal has shifted into red zone again with increased volatility. Further the positions constructed for bull overview will increase in value with time...

- Market Data