USD presents superior moves over INR adding space by US equities, further upside luring future

Apr 24, 2015 13:20 pm UTC| Insights & Views

US stock market booms as quick growth in biotechnology companies such as Gilead Sciences Inc and social media firms like Facebook Inc and also driven by the popularity of mobile computing. Further index fueled by shares of...

Yen's rally stalls on growth projections and central bank’s policy measure

Apr 24, 2015 12:47 pm UTC| Insights & Views

The Bank of Japan (BoJ) is sensing inflation may rub it wrong way. Thus, as a precautionary measure it will hold Monetary Policy Committee meeting on 30 April. Evaluation of semi-annual GDP and inflation forecasts are the...

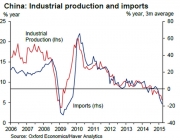

Chinese growth hopes only on monetary easing

Apr 24, 2015 11:53 am UTC| Insights & Views

The increased industrial funding costs of China are likely to have a toll on eroded profit margins. Manufacturing production and revenues are projected to be under stress given sluggish domestic demand and the constant...

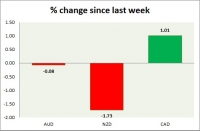

Currency snapshot (commodity pairs)

Apr 24, 2015 11:08 am UTC| Insights & Views

Dollar index trading at 97.15 (-0.16%). Strength meter (today so far) - Aussie +0.12%, Kiwi -0.25%, Loonie +0.18%. Strength meter (since last week) - Aussie -0.08%, Kiwi -1.73%, Loonie +1.01%. AUD/USD - Trading at...

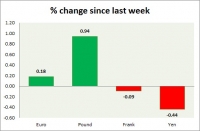

Currency snapshot (major pairs)

Apr 24, 2015 10:28 am UTC| Insights & Views

Dollar index trading at 97 (-0.32%). Strength meter (today so far) - Euro +0.48%, Franc -40%, Yen -0.05%, GBP +0.53% Strength meter (since last week) - Euro +0.18%, Franc -0.09%, Yen -0.44%, GBP +0.94% EUR/USD...

Stage set for handsome gains for Crude

Apr 24, 2015 10:07 am UTC| Insights & Views

We keep urging often and often concentration on demand/supply equation is the genuine fundamentals than anything else cooking around the world. And this in turn evidenced here, the surge in futures of crude oil over a...

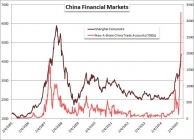

Rational or not, this is how Chinese dragon rises

Apr 24, 2015 08:59 am UTC| Insights & Views

Chinas benchmark equity index rose to new post crisis high, however was down -0.47% in the closing. Neither weak economic data, nor global risk aversion is succeeding to break the bulls or rather say Chinese Dragon. It is...

- Market Data