Oct 05, 2018 07:21 am UTC| Research & Analysis Insights & Views

GBPJPY has shown a stern downtrend when it attempted for consolidation phase. Its been dipping again from the recent peaks of 149.716 levels on bearish engulfing candle. Weve explicitly highlighted further bearish...

FxWirePro: Projections and positioning RUB via optionality on unpredictable geopolitical risks

Oct 04, 2018 13:59 pm UTC| Research & Analysis Central Banks

Recently, the Russian central bank (CBR) announced that it was officially suspending FX purchases on behalf of the finance ministry until the end of this year; it added that it may resume FX purchases in 2019 but the issue...

Oct 04, 2018 13:04 pm UTC| Research & Analysis Digital Currency Insights & Views

Bitwise optimistic onCrypto Index Investment Fund,despite SECs deferment of approval of crypto-index ETFs. Well, the San Francisco-based asset management company, Bitwise filed for the first publicly-offered...

FxWirePro: BRL call ratios to achieve striking risk reward ahead of Brazilian polls

Oct 04, 2018 12:26 pm UTC| Research & Analysis Insights & Views

Long expiry BRL call ratios: At the currently fairly extended pricing of the 2nd round of the election event risk (refer above chart)the curve is unlikely to invert much further. Vol surfaces tend to drop after election...

FxWirePro: Crude Oil Projections for Q4 – A Glimpse at WTI and Brent Derivatives

Oct 04, 2018 10:17 am UTC| Research & Analysis Insights & Views

The projections of crude oil are revised for 4Q18 Brent by $22/bbl to $85/bbl and 2019 Brent by $20.5/bbl to $83.5/bbl. Projections of WTI are also revised for 4Q18 by $19.8/bbl to $75.83/bbl and 2019 prices higher by...

Oct 04, 2018 09:42 am UTC| Research & Analysis Technicals Insights & Views

The WTI crude oil price rallies have extended their recent recovery upto the current $76.26 levels. Technically,WTI crudeon daily plotting forms flag pattern which is bullish in nature formed at $73.44 and $74.87...

FxWirePro: Driving forces of CAD and JPY – Trade options straps and bid short hedges

Oct 04, 2018 07:43 am UTC| Research & Analysis Insights & Views

The driving forces of CAD: NAFTA negotiations turn south especially for Canada; Canadian growth slowdown extends vis-à-vis US; (3) Local oil prices weaken further BoC signals a more aggressive path...

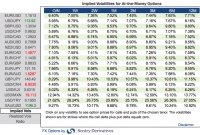

- Market Data