Mar 29, 2018 07:30 am UTC| Research & Analysis Central Banks Insights & Views

The currency markets navigated two major events over the past week that left the broad dollar with no more directional clarity than before. The March FOMC under new Fed Chair Powell raised rates as widely anticipated and...

Mar 28, 2018 12:35 pm UTC| Research & Analysis Insights & Views

USD-EM spot rates should be upwardly biased, and the bulk of total return performance in 2018, if any, should come via carry similar to the past two years. The risk to our forecasts is a stronger performance in 1H2018....

Mar 28, 2018 12:22 pm UTC| Research & Analysis Insights & Views Central Banks

Following the initial flash crash earlier last Friday, the Turkish lira appeared to be stabilized for a while before it continues to depreciate slightly again. The lira is not alone in this: currencies such as the forint...

FxWirePro: Uphold call spreads to hedge WTI crude price risks ahead of US EIA’s inventory report

Mar 28, 2018 11:31 am UTC| Research & Analysis Insights & Views

Today, WTI crude prices dragged yesterdays loses below $65 mark ahead of the speculation on weekly supply data which is scheduled later in the day would release if there is a huge build-up in U.S. oil supplies. The U.S....

Mar 28, 2018 09:01 am UTC| Research & Analysis Insights & Views

The FX market seems to be gripped by springtime lethargy. Even though there are some plausible moves, such as a weaker euro following some cautious comments by ECB officials or the dollar easing slightly in reaction to...

FxWirePro: Deviate and hedge EUR/USD risks in EUR/NZD via knock out options

Mar 28, 2018 07:09 am UTC| Research & Analysis Central Banks Insights & Views

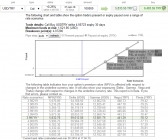

Our RBNZ outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%. While we pair EUR vs NZD to...

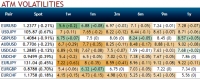

FxWirePro: Option derivatives themes amid hovering trade protectionism regimes

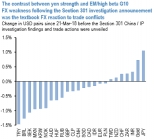

Mar 27, 2018 12:36 pm UTC| Research & Analysis Insights & Views

The current global macro environment is characterized by weak economic volatility. One of the consequences is that FX volatility has been depressed since most of 2H17. Sustained growth but still-soft inflation dynamics are...

- Market Data