Sep 12, 2017 07:42 am UTC| Research & Analysis Insights & Views

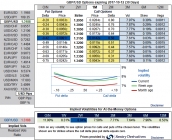

Please be noted that the GBP IVs have been progressively shrinking away. The cable volatility surface has returned to levels seen at the start of the year overall, while risk reversals have slightly shifted into...

Sep 12, 2017 06:03 am UTC| Research & Analysis

Notable economic data releases and events will be reserved for later in the week. They include the Bank of England policy decision on Thursday, which will be preceded by an expected tick up in consumer price inflation on...

Sep 11, 2017 12:28 pm UTC| Research & Analysis

The Turkish lira has been trading vigorously in the recent months and it has continued its robustness through August, although its performance has been far more impressive against the ultra-weak USD than against the basket...

FxWirePro: Key driving forces of USD/KRW and hedging strategy

Sep 11, 2017 11:50 am UTC| Research & Analysis Central Banks Insights & Views

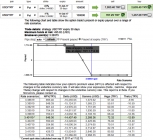

The downside in USDKRW has been bounded by 1113, even with the EUR marching higher and EM currencies strengthening. It has witnessed a good run in 1Q among EMFX, subsequently, resulting in the KRW being one of the...

FxWirePro: Impact of PBoC’s FX regime on CNY NDFs

Sep 11, 2017 10:48 am UTC| Central Banks Research & Analysis Insights & Views

The strength of CNY can be traced to three factors: the rebound in real GDP, higher commodity prices (which has aided the reflation theme and reduced pressure on the banking system) and higher interest rate...

Sep 11, 2017 09:23 am UTC| Research & Analysis Insights & Views

AUDNZD is heading towards 1.1200 during the days ahead, as long as Australian and Chinese data doesnt disappoint. In medium term perspective, a retest of the 1.1200 area seen in April is possible if iron ores rally...

FxWirePro: Bullish, bearish scenarios and hedging vehicles of Aussie and Kiwi dollar

Sep 11, 2017 07:10 am UTC| Research & Analysis Insights & Views

Bearish AUD scenarios: 1) The unemployment rate moves back towards 6%, forcing the RBA to respond more aggressively to weak inflation; 2) China data weaken materially. Bullish AUD scenarios: 1) China eases...

- Market Data