FxWirePro: How does GBP/JPY fundamentals appear ahead of BoJ?

Sep 19, 2017 07:37 am UTC| Research & Analysis Insights & Views

Bullish GBP scenarios: 1) The govt. formalizes a lengthy transitional deal with the EU which maintains the status quo for 2-3 years. 2) The economy rebounds to 2%. The UK economy advanced 0.3 percent on quarter in...

FxWirePro: SGD NEER appears too rich and good funding currency but skew metrics tepid

Sep 18, 2017 13:49 pm UTC| Research & Analysis Insights & Views

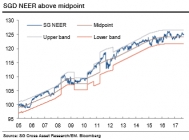

It is believed that SGD would be a regional underperformer and should be used as a funding currency. The chance of the MAS tightening policy is very low and instead we assign a 70% chance that the midpoint of the SGD NEER...

FxWirePro: Directional interpretations in vol space of EMFX pool

Sep 18, 2017 12:39 pm UTC| Research & Analysis Insights & Views

Before we begin with this write up lets just have a glimpse through EMFX: We stay OW EM FX. In EMEA EM, we diversify long RUB and TRY with short ZAR, and hold OW CZK vs. UW RON. In LATAM, we recently rotated out of OW CLP...

FxWirePro: WTI crude price sentiments and hedge price risks via diagonal credit put spreads

Sep 18, 2017 12:28 pm UTC| Research & Analysis Insights & Views

In our recent technical write up, weve already stated that WTI crude prices are struggling to break out the stiff resistance from last couple of days. For more reading on this post, refer below...

FxWirePro: All goes in favor of Mexican peso – Hedging perspectives of bearish USD/MXN

Sep 18, 2017 11:50 am UTC| Research & Analysis Insights & Views

The MXN should perform well until the end of this year on strong GDP growth in its biggest trading partner (the US), high positive carry, and diminished worries of NAFTA termination (risk premium has subsided but can fall...

FxWirePro: Sizable impacts of North Korea risk on USD/JPY ahead of Fed and BoJ

Sep 18, 2017 09:49 am UTC| Research & Analysis Insights & Views Central Banks

As far as the US and Japanese currencies are concerned everything will center on the imminent FOMC and BoJ meetings that are scheduled this week. The USD positive effect of the inflation data did not last long last week....

Sep 18, 2017 08:07 am UTC| Research & Analysis Insights & Views

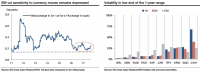

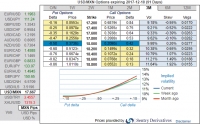

Please be noted that the implied volatility of ATM contracts of USDJPY across 1w-1m tenors are shrinking lower despite this weeks monetary policy meetings of Fed and BoJ, just shy above 10.85% and 9.35% for 1w 1m tenors...

- Market Data