Sep 21, 2017 13:04 pm UTC| Central Banks Research & Analysis Insights & Views

SARB meets today to make a monetary policy decision: the majority of analysts expect a 25bps cut to the benchmark rate today. The South African Reserve Bank lowered its benchmark repo rate by 25bps to 6.75 percent on July...

Sep 21, 2017 12:02 pm UTC| Research & Analysis Insights & Views

Very recently, the British Foreign Secretary Boris Johnson will hopefully not take it personally that Sterling appreciated briefly yesterday in reaction to reports he might resign. We interpret the exchange rate moves in...

FxWirePro: Not to buck EUR/PLN trend, three fundamental factors to drive gutsy shorts

Sep 21, 2017 10:15 am UTC| Research & Analysis

Polish zloty has been under pressure since May. Ongoing political tensions with the EU regarding the countrys overhaul of the judiciary have raised the spectre of Article 7 sanctions. Additionally, dovish rhetoric from...

Sep 21, 2017 09:28 am UTC| Research & Analysis Insights & Views

This weeks EIA (Energy Information Adminstration) report has been bearish for crude and bullish for gasoline and distillate. Overall, this report was bullish compared to the previous two reports; total commercial crude and...

Fitch: Morocco Reserve Fall Unlikely to Prompt FX Policy Shift

Sep 21, 2017 09:25 am UTC| Research & Analysis

Fitch Ratings still expects an eventual widening of the Moroccan dirhams floating bands, despite the fall in foreign-currency reserves in 2Q17. Reserves have now bottomed out and we expect the authorities to implement...

Fitch: Turkish Banks' External Debt Ticks Up but Liquidity Sound

Sep 21, 2017 08:39 am UTC| Research & Analysis

Turkish banks external debt increased in the first half of 2017 but the sectors foreign-currency (FC) liquidity remains sufficient to cover maturing short-term FC debt, Fitch Ratings says. Banks external debt rose USD9...

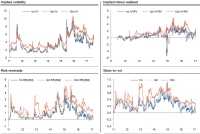

FxWirePro: Key drivers of bullish CNY - Identify dislocations between IVs, RVs and RRs

Sep 21, 2017 08:08 am UTC| Research & Analysis Insights & Views

No doubt from last two weeks, USDCNY has been spiking higher to the current levels of 6.5954 from the recent lows of 6.4345 levels. However, it is foreseen that the strength of CNY can be traced to three factors: The...

- Market Data